Cryptocurrencies are reshaping global industries as adoption grows across payments, retail, financial services, and remittance. With the crypto market cap crossing trillions and over 820 million unique wallets active worldwide, crypto coins are evolving from niche technology into everyday transactional tools. As custodial wallet adoption grows and 60% of users prefer unified financial platforms, industries shift toward more connected, user-centric digital ecosystems.

Businesses use blockchain technology to integrate crypto-friendly operations that reduce settlement delays and cut transaction overheads. The rapid 55% growth in crypto payment adoption highlights a global willingness to embrace faster, borderless value exchange. As a result, organizations restructure processes to support real-time settlements, improved liquidity movement, and transparent audit trails.

This transformation also brings new opportunities for customer engagement, as crypto payments increase efficiency and convenience. Users gain the freedom to transact globally without experiencing the limitations of traditional financial corridors. With cryptocurrencies redefining how value flows across platforms, industries enter a new era of digital acceleration and competitive innovation.

Redefining remittance with custodial crypto wallet

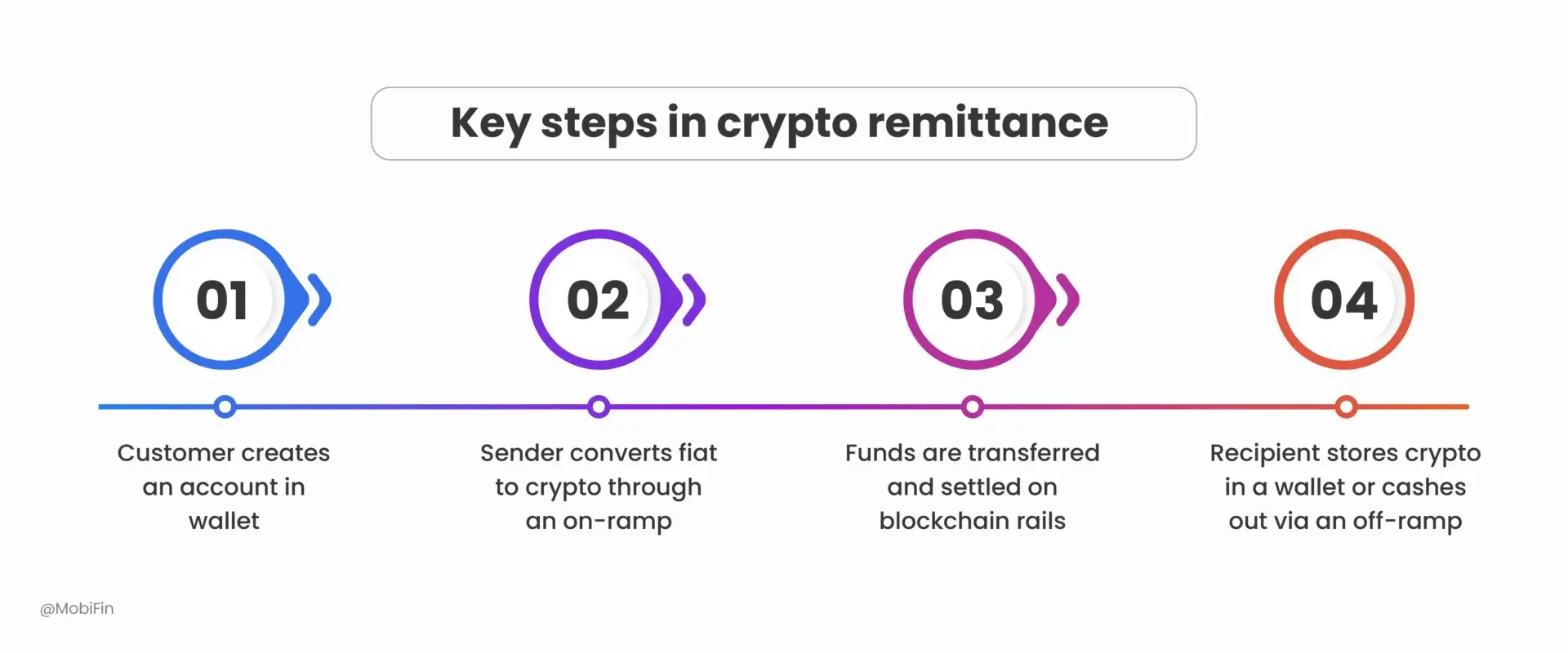

Crypto redefines remittance by removing layers of intermediaries that traditionally increase cost and slow transfers. Users create an account in custodial wallet, purchase crypto coins with fiat, send funds across a blockchain network, and allow recipients to store or convert instantly. Crypto remittance saves customers 2-8% in fees compared to traditional methods and reduces transfer time from several days to a matter of seconds.

Key steps in crypto remittance

Crypto remittance fees remain low because blockchain removes intermediaries, automates settlement through smart protocols, enables peer-to-peer transfers, and operates on decentralized networks. This structure reduces operational costs, speeds up transactions, and avoids high banking, FX, and correspondent fees common in traditional remittance systems.

Stablecoins like USDT and USDC remain popular for remittances, enhancing consistency by maintaining a 1:1 peg that protects recipients from market volatility. This stability makes crypto an attractive option for families, workers, and businesses that depend on predictable cross-border crypto payments. As confidence grows, crypto remittance becomes a reliable, low-cost alternative to conventional money transfer methods.

Custodial crypto wallet integration is the new era of business evolution

Many platforms like digital wallets, digital banks, and other financial service providers collaborate with FinTech players to integrate custodial crypto wallets into their platforms. This enables them to earn revenue through platform fees on domestic and international transfer. Buy, sell, transfer, and swap flows create continuous transaction cycles that generate recurring revenue for all stakeholders.

Businesses adopting hybrid models of fiat and crypto stay competitive by offering speed, flexibility, and multi-currency functionality. On-chain settlements allow cross-border transfers to finalize within seconds, eliminating regional barriers. This efficiency strengthens user loyalty, as customers appreciate the ability to move funds anytime, anywhere without friction.

Custodial crypto wallet integration represents a new era where users can manage fiat and crypto transactions within the same platform. People buy crypto through on-ramps, transfer assets on-chain, and cash out through off-ramps all in seamless flow. This model increases engagement because users interact with the platform at multiple points in the value cycle.

For digital wallet providers, transforming a standard wallet into a hybrid wallet is essential for expanding functionality and meeting evolving user expectations. Users access both fiat services and crypto capabilities without requiring separate platforms or complex processes. As companies integrate blockchain features more deeply, hybrid wallets become essential tools for modern financial growth.

Secure crypto accounts for seamless transactions

Security remains central to mainstream crypto adoption as the user base expands. FinTech companies offer custodial crypto accounts with strong encryption, global standards, and compliance-driven frameworks to safeguard digital assets. Users gain secure access through recovery phrases like the BIP-39 standard, ensuring they maintain control over their accounts and protect their assets.

Seamless transactions depend on sophisticated verification systems that run in the background without disrupting user experience. Real-time address validation, gas-fee customization, and password/MPIN-based approvals create a secure yet flexible environment for everyday transfers. These layers of protection ensure reliability across both small and large transactions.

Regulatory advancements strengthen market confidence by providing clear guidelines for crypto account operations. Compliance frameworks reduce risks such as fraud, unauthorized access, and operational inconsistencies. With robust governance and modern technology working together, crypto accounts become safe, dependable, and easy to use across digital platforms.

Empowering blockchain integration with flexibility and future-readiness

Service providers can choose which cryptocurrencies, stablecoins, or blockchain standards to offer, ensuring users receive a personalized and relevant experience. Ultimately, all service providers must select the right FinTech platform to integrate a custodial crypto wallet into their ecosystem, along with other integrations such as on-chain and crypto exchange services.

On-chain platform integration enables secure customer account registration, transaction processing, and real-time balance management. Crypto exchange integration enables service provider account registration (escrow) and empowers them to manage crypto operational wallet using fiat currencies. Leading FinTech platforms offer custodial crypto wallets withsuch pre-integrated capabilities and flexible customization options.

Modular integration frameworks allow service providers to add more blockchains, tokens, or compliance controls as the market evolves. Supporting networks give users access to widely trusted and adopted assets such as ETH, USDT, USDC, BTC, and other established digital currencies, ensuring liquidity, stability, and global acceptance across transactions.

Conclusion

Crypto redefines remittance by enabling instant, low-cost global transfers. Custodial wallet integration unifies fiat and crypto in one secure experience. Blockchain technology providers power this shift with modular,scalable infrastructure. Service providers have the opportunity to expand their ecosystem by integrating custodial crypto wallets, on-chain services, and crypto exchange capabilities through the right FinTech platform.

If you wish to integrate custodial crypto wallet in your business, get in touch with MobiFin experts right away.

Frequently asked questions

Crypto remittances are legal in many countries but are subject to local regulations. Most compliant providers operate under licensing frameworks and enforce KYC, AML, and transaction monitoring requirements similar to traditional financial institutions.

Users convert crypto into local currency through exchanges, regulated on/off-ramps, or digital wallets connected to bank accounts and agent networks, enabling cash-out or direct spending.

No. Most crypto-powered remittance services hide blockchain complexity. Users interact with familiar wallet or remittance apps while crypto operates invisibly in the background.

Many remittance platforms use stablecoins pegged to fiat currencies. These minimize price volatility while retaining the low-cost and fast-settlement advantages of blockchain infrastructure.

Blockchain transactions are cryptographically secured and immutable. When combined with regulated custody, secure wallets, and compliance controls, crypto remittance systems offer high levels of operational and transactional security.

Yes. Crypto remittance platforms can reach underbanked populations through mobile wallets, USSD access, and agent networks, reducing dependency on traditional banking infrastructure.

Key challenges include regulatory uncertainty, on/off-ramp availability, user education, fraud prevention, and integrating crypto rails with local payment ecosystems.