Case Studies

AI-powered onboarding

Streamlines onboarding with intelligent tools, such as OCR, liveliness and Deepfake checks, eKYC, blocklist screening, and AML compliance. Ensures secure, efficient verification and risk management while also facilitating agent-assisted onboarding. Accelerates wallet adoption with secure, compliant onboarding, reduces fraud risk, and expands financial access for diverse customer segments.

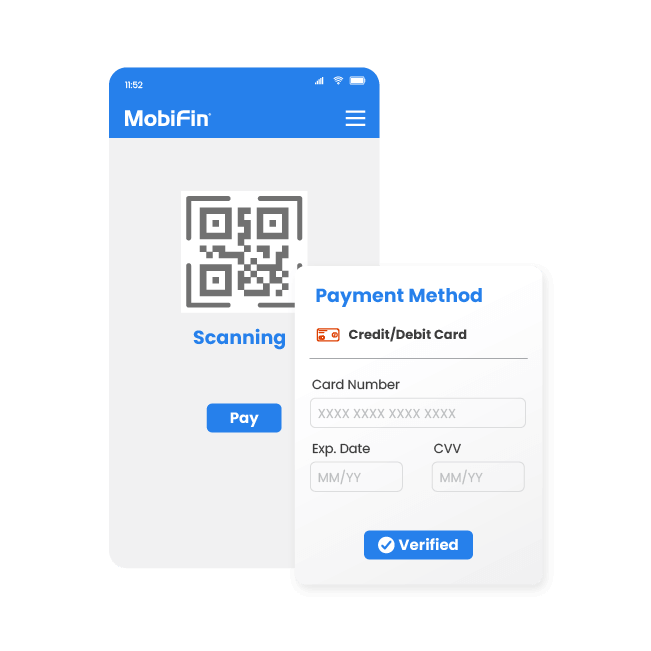

Real-time payments and transfers

Facilitates cash-in/out via agents or self-service, with P2P transfers, remittances, QR-based merchant payments, bill settlements, mobile recharges. Offers additional smart features like standing instructions, recurring and split payments – all in real-time. Enhances customer convenience, supports financial inclusion, and strengthens loyalty through fast, flexible, and seamless digital payments.

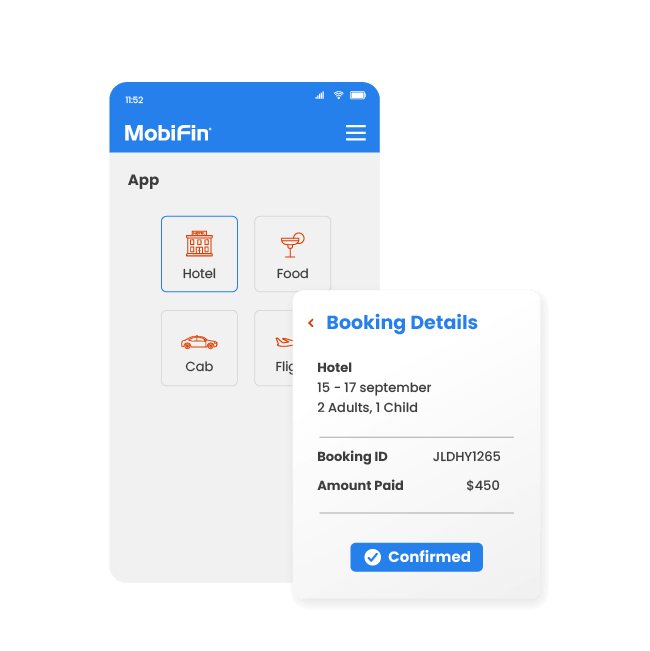

SuperApp framework

Takes the wallet beyond transactions, enabling lifestyle services like food delivery, ride-hailing, groceries, travel bookings, and more, within one unified experience. Integrates day-to-day services, saves time, and enhances convenience. Boosts customer engagement and stickiness. Generates new revenue opportunities for banks and financial institutions.

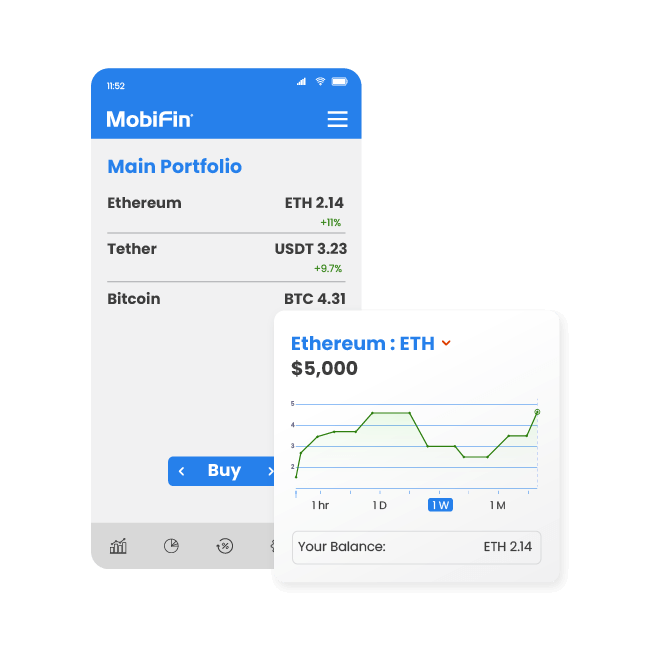

Hybrid Crypto wallet

Supports both fiat currencies and digital assets and allows users to buy, sell, and swap crypto with ease. Policy-based governance ensures compliance, while dynamic gas fee handling optimizes transaction costs. Empowers customers with secure asset management and greater financial freedom. Also accelerates adoption of blockchain-enabled financial services within regulated ecosystems.

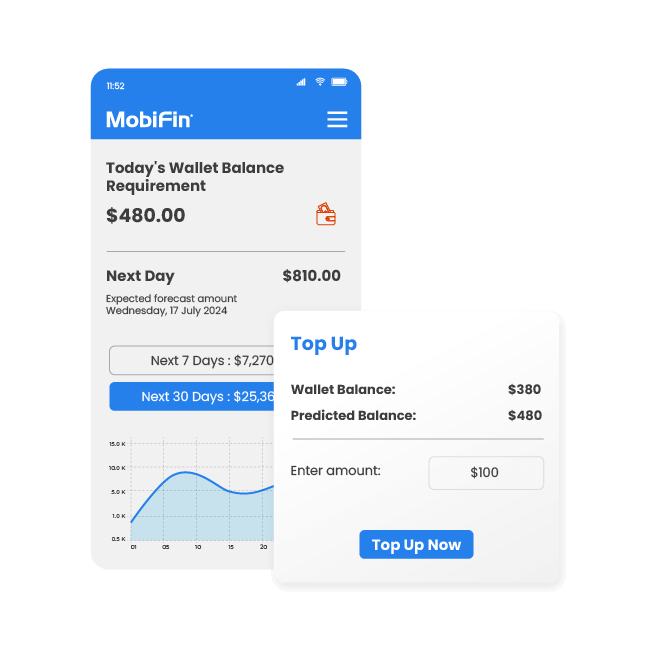

AI-enabled liquidity prediction

Smartly predicts the required float and cash levels for day, week, and month. Empowers agent networks easily top-up their wallet balances as per the forecast by liquidity prediction with AI. Prevents transaction failures, improves customer trust, enhances service reliability, and optimizes working capital through accurate AI-driven liquidity forecasting.

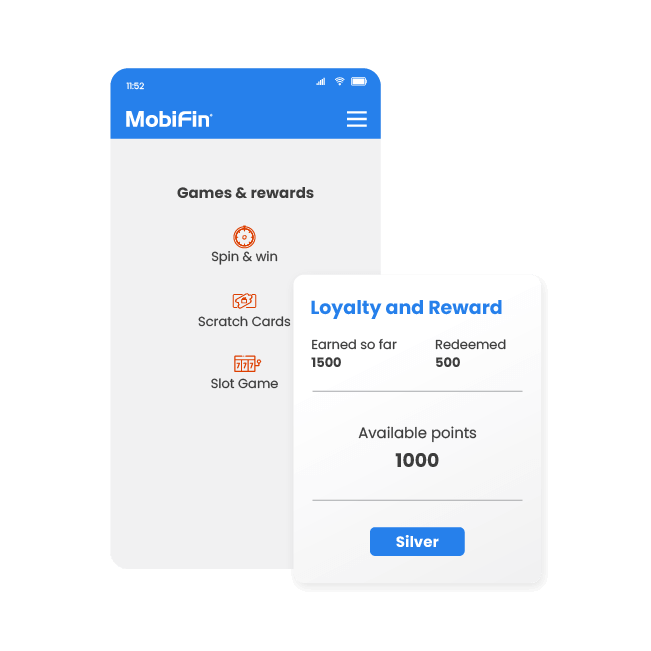

Gamified loyalty and rewards

Presents games such as Spin the Wheel, Slot, Scratch Card, etc., to win prizes. Offers multiple tier-based loyalty profiles like silver, gold, platinum, and more, for unlocking higher-value or premium rewards. Increases customer engagement, boosts retention, drives repeat usage, and strengthens brand loyalty through tier-based rewards.

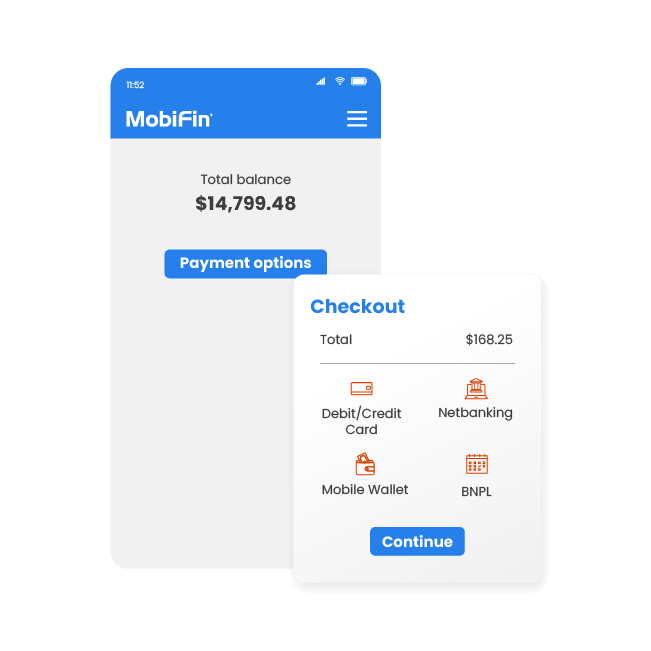

Multi-payment instruments

Combines e-money, accounts, cards, vouchers, and loyalty points in one vault, with added flexibility through instant credit options like BNPL, overdrafts, and mobile-first micro-loans. Improves convenience, enhances spending flexibility, and promotes financial inclusion. Further drives customer satisfaction by unifying multiple payment instruments with instant credit access.

Frequently asked questions

MobiFin’s digital wallet provides various onboarding options, including self-registration via a mobile app or web portal, assisted onboarding at field locations, and bulk onboarding through backend processes. These flexible options ensure that different types of users—such as customers, agents, and merchants—can easily register for the wallets.

We support multiple payment instruments, allowing you to use debit/credit cards, linked bank accounts, and monetary and non-monetary wallet balances. Our digital wallet is compatible with a wide range of payment methods, including QR codes, USSD, and web interfaces, making it versatile for digital payments.

MobiFin’s architecture incorporates advanced measures such as two-factor authentication, role-based access control, TOTP login mechanism, and dynamic maker-checker-approver flows. MobiFin also adheres to Payment Card Industry (PCI) standards and supports real-time Anti-Money Laundering (AML) rules for ensuring the security of digital wallet transactions.

Yes, MobiFin enables multiple business entities to operate on a single platform instance with logical data isolation for each tenant. This approach helps manage various tenants or customer groups with different configurations.

Yes, our digital wallet’s microservice-based architecture and advanced caching/load-balancing mechanisms enable it to handle high transaction volumes efficiently, ensuring quick and reliable transactions, even during peak usage.

MobiFin enables businesses to set up dynamic transaction rules and counters, allowing them to establish limits on transaction frequency or volume or amount, enforce velocity checks, and implement specific rules for different transaction types, all managed through the platform’s admin interface.

Yes, MobiFin’s digital wallet includes advanced business hierarchy management, allowing businesses to build multi-level agent and distributor networks. The platform also incorporates target management features to optimize processes and enhance overall efficiency.

Yes, our digital wallet includes a loyalty and rewards feature, where users can earn loyalty points, redeem them for vouchers, and upgrade to higher loyalty tiers to unlock additional benefits.

Yes, MobiFin allows for international remittances by integrating with third-party remittance providers. This feature enables users to transfer funds globally, enhancing cross-border financial inclusion and convenience.

top-up?

Yes, MobiFin has an exclusive biller integration module which helps service providers to integrate billers and offer bill payment and top-up services to subscribers.