Case Studies

Primary Features

Revolutionize your banking services beyond branches with our agency banking solution

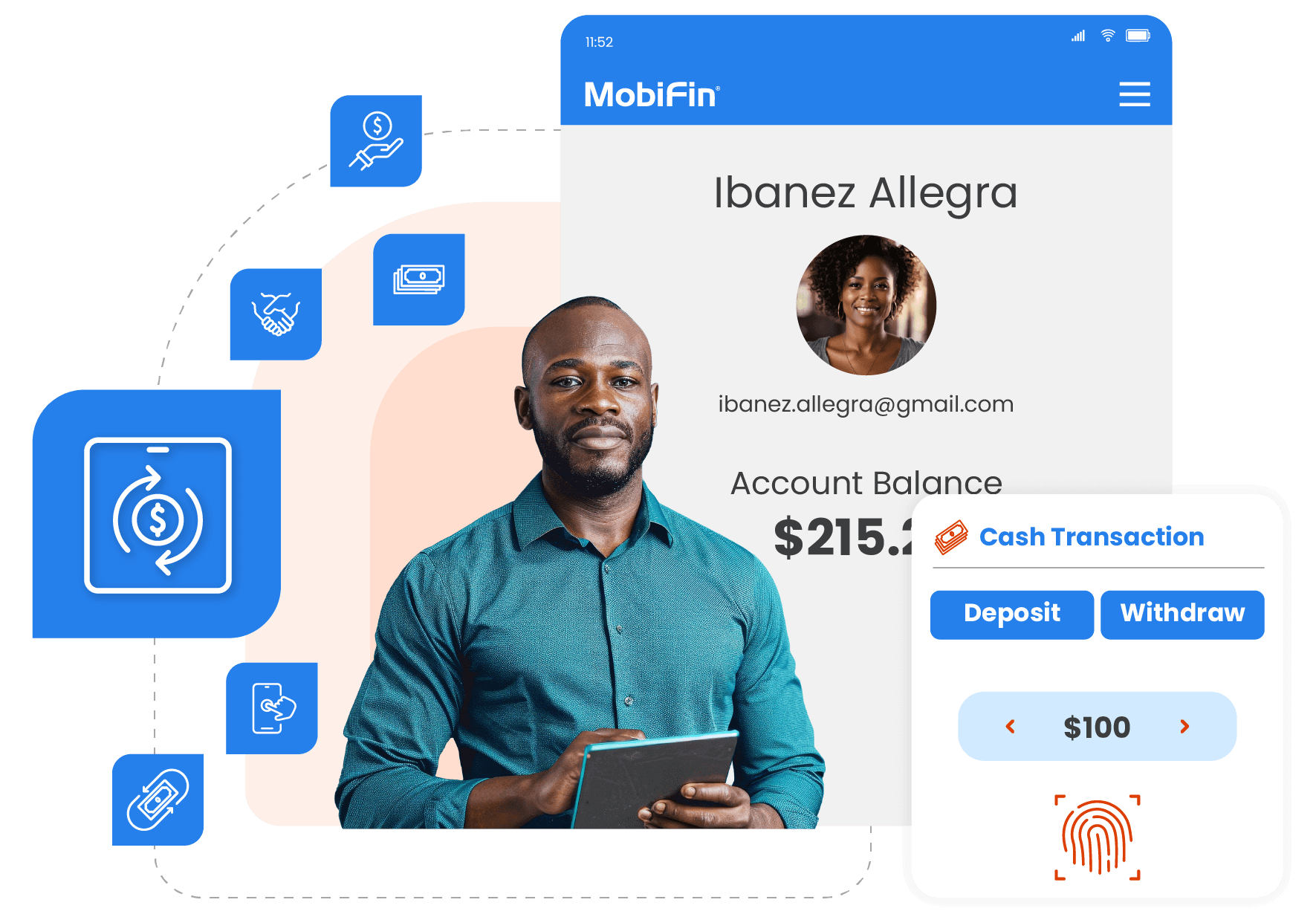

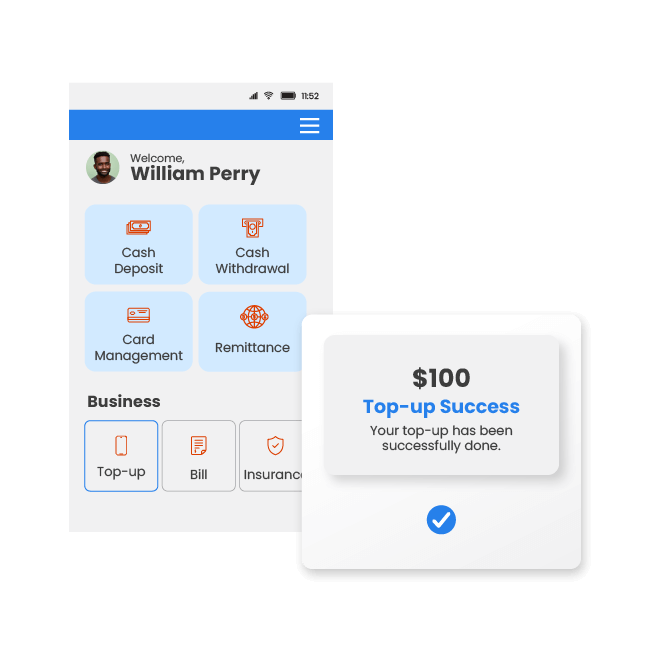

Wide catalog of agent-assisted services

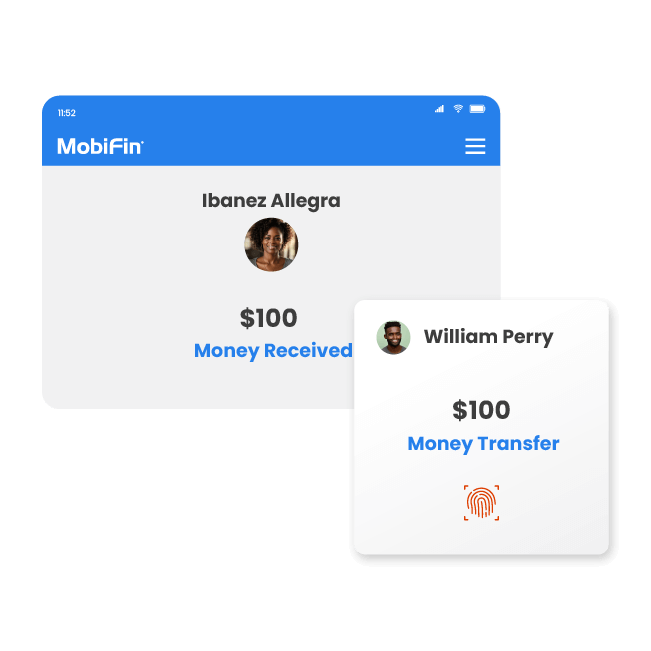

Facilitates agents and outlet operators to offer customers core services like cash deposits, cash withdrawal, card management, loans, and remittance. Also, extends diverse revenue-added-services like top-up, bill payment, insurance, and more. Expands customer access to essential and value-added services, deepening financial inclusion and enhancing loyalty. Also creates additional revenue streams for agents and banks.

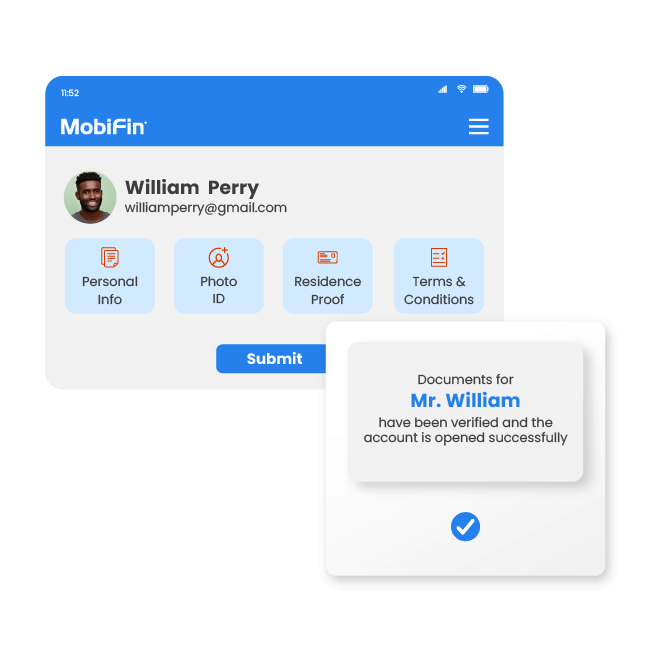

AI-powered digital onboarding kit

Leverages OCR, liveness, Deepfake detection, eKYC, sanction screening, and AML checks to drive bank-assisted or self-service onboarding for agents and outlet operators. Enables agent-assisted onboarding for customers. Enhances customer trust through secure, compliant onboarding, minimizes fraud risk, and accelerates account opening. Broadens financial access for unbanked and underbanked populations.

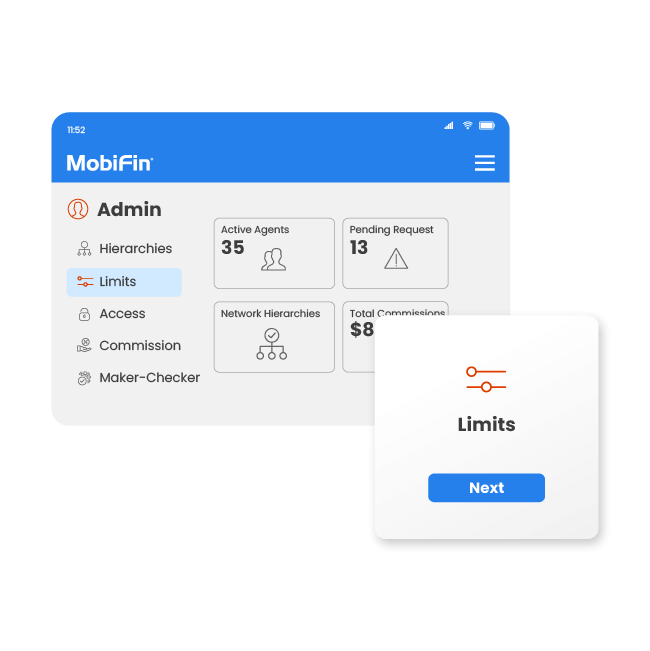

NxM agent network management

Builds and scales high-performing agent networks with configurable controls for hierarchies, limits, access, commissions, maker-checker workflows, and reporting. Expands agent network, improves oversight, boosts productivity, and ensures compliance. Maximizes efficiency through optimized performance and transparent operations.

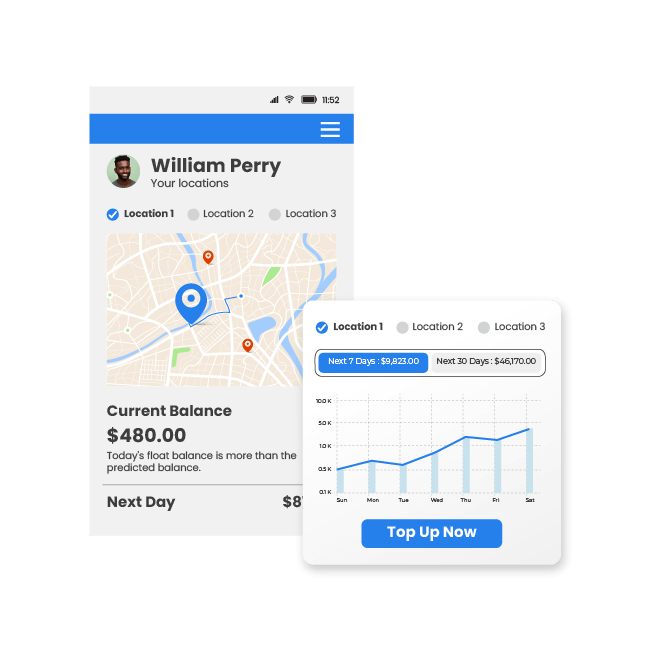

AI-enabled liquidity prediction

Balances account/float and cash for upcoming daily, weekly, and monthly requirements. Prevents declined transactions with AI-enabled liquidity predictions. Assures service reliability by preventing cash shortages and improving customer satisfaction. Reduces downtime and strengthens agent trust by providing timely and sufficient funds.

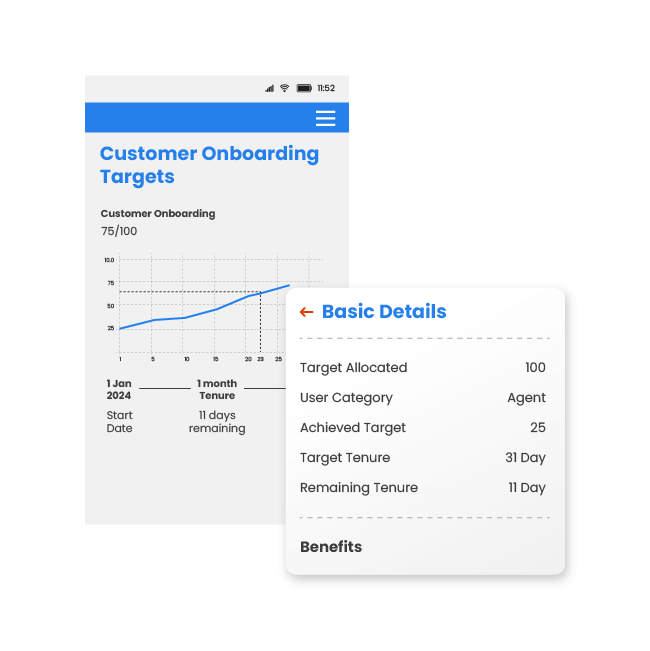

Target and performance management

Sets targets for parent/child agent entities and outlet operators based on user onboarding or transaction amounts, with live performance dashboards for progress tracking. Drives structured incentive control and tiered rewards with fixed or percentage commissions. Motivates agents with clear targets and boosts productivity through transparent performance monitoring. Increases engagement via structured incentives and tiered rewards.

Advanced liquidity tools

Offers real-time float monitoring, structured overdrafts, agent-to-agent transfers, and pooled float access. Ensures uninterrupted services with always-available cash management. Guarantees uninterrupted transactions, strengthens agent confidence, and improves customer trust. Optimizes working capital through smarter and flexible liquidity management capabilities.

Frequently asked questions

Agent float management and its real time settlement will be primarily handled within the MobiFin Agency Banking (E-money) system, ensuring efficient and secure control over agent funds.

Yes, our platform fully supports agent onboarding, agent hierarchy management, and a diverse range of financial and non-financial services as listed in the next FAQ answer.

MobiFin offers a range of banking services, including

- Bank deposits and withdrawals

- Top-up, Bill and loan repayments

- Electronic fund transfers

- Account balance inquiries

- KYC and other document collection on behalf of service provider

- Agent assisted customer onboarding

Yes, as a white labelled platform we offer a high degree of flexibility, allowing you to tailor the look and feel, branding elements, and user-friendly interface to align seamlessly with your existing brand identity.

Our platform offers flexible capabilities for managing fees, revenue, and limit policies, which includes the ability to configure real-time or deferred weekly/ monthly commission payouts.

MobiFin employs robust security measures to protect agency banking transactions. These include strong user authentication, role-based access control, data encryption at rest and in transit, and adherence to industry security standards

Yes, our platform offers flexible integration capabilities that allow for seamless integration with various third-party services, including banking ecosystems, top-up providers, and bill payment systems within your system and infrastructure.

MobiFin’s flexible, modular, and scalable micro-service architecture ensures high availability, performance, and scalability to handle your growing business needs.

MobiFin offers a comprehensive suite of reporting and analytics tools, that are easily accessible through mobile application. These provides valuable insights into your agents’ activities and performance.

Our agency banking platform ensures compliance with international regulatory requirements such as ISO 27001 and NIST. In addition, we are also able to comply with regional and local regulatory requirements. For example, CRDB Bank Plc, an African bank and the leading financial services provider in Tanzania, uses our agency banking platform, which meets all local regulatory requirements.