According to tech analyst Gartner, by 2025, up from 41% in 2022, up to 50% of investment in the application software, infrastructure software, business process services, and system infrastructure industries would have moved to the cloud. It predicts that by 2022, cloud computing would account for over two-thirds of application software spending, up from 57.7% in the previous year.

Traditionally, core banking systems were operated on-premises, involving expensive hardware, maintenance costs, and limited scalability. However, with the advent of cloud-based services, the financial industry is witnessing a paradigm shift towards digital core banking solutions. In this blog, we will explore the significance of core banking systems, the advantages of cloud-based solutions, key players in the market, and how this shift is transforming the banking sector.

Understanding Core Banking System

A core banking system forms the backbone of a financial institution’s operations, encompassing a centralized database that stores and manages customer data, accounts, transactions, and other essential banking functionalities. It serves as a platform for various banking services, including account management, deposits, loans, payments, and other financial transactions. The efficiency and reliability of a core banking system directly impact a bank’s ability to provide seamless services to customers while ensuring regulatory compliance.

Advantages of Cloud-Based Core Banking Solutions

Cost-Effectiveness

Cloud-based core banking solutions eliminate the need for extensive on-premises infrastructure, reducing hardware and maintenance costs significantly. Financial institutions can pay for the services they use, making it a cost-effective option, especially for smaller banks and startups.

Scalability

Cloud-based core banking systems offer seamless scalability, allowing banks to quickly adapt to changing business demands. Whether it’s expanding operations or accommodating a growing customer base, cloud solutions can efficiently scale up or down, providing a flexible and future-proof infrastructure.

Enhanced Security

Leading cloud service providers offer robust security measures to protect sensitive financial data. With dedicated security teams, encrypted data storage, and regular security updates, cloud-based core banking systems often provide a higher level of security compared to on-premises solutions.

Faster Time-to-Market

Cloud-based core banking solutions can be deployed and implemented more swiftly than traditional systems, reducing the time-to-market for new products and services. This agility enables banks to remain competitive in a rapidly evolving financial landscape.

Seamless Integration

Cloud-based solutions offer seamless integration capabilities, allowing banks to integrate with third-party applications, FinTech partners, and other digital platforms. This integration facilitates the development of innovative services and enhances customer experience.

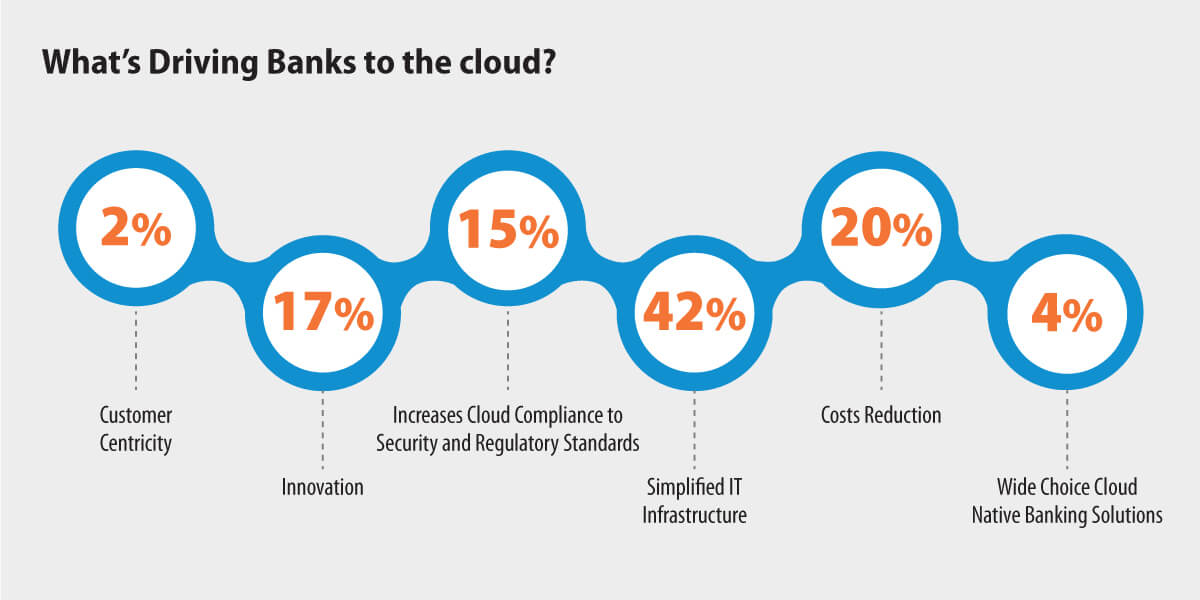

Top Reasons Why There is a Shift Cloud-Based Core Banking Services

The paradigm shift of core banking towards cloud-based core banking services is driven by several factors that have revolutionized the way financial institutions operate and deliver services. Let’s explore the key reasons behind this transformation:

Cost-Effectiveness

Traditional on-premises core banking systems require a substantial upfront investment in hardware, software, maintenance, and IT infrastructure. Cloud-based core banking services eliminate the need for expensive hardware and maintenance costs, making it a more cost-effective option for financial institutions. Cloud services operate on a pay-as-you-go model, allowing banks to pay only for the resources they consume, leading to significant cost savings.

Scalability and Flexibility

Cloud-based core banking services offer unparalleled scalability, allowing financial institutions to expand or contract their infrastructure as per their business requirements. This flexibility is crucial in accommodating changing customer demands, regulatory requirements, and market conditions. Cloud services enable banks to quickly scale up to handle increased workloads during peak periods and scale down during quieter times, optimizing resource utilization.

Faster Time-to-Market

Cloud-based core banking services can be implemented and deployed much faster than traditional on-premises solutions. This accelerated deployment ensures quicker time-to-market for new products, services, and innovations, giving financial institutions a competitive edge in the rapidly evolving banking landscape.

Enhanced Security Measures

Leading cloud service providers implement robust security measures to protect sensitive financial data. They invest heavily in dedicated security teams, encryption, multi-factor authentication, and regular security updates, offering a higher level of security compared to many on-premises systems. This addresses the concerns of data breaches and cybersecurity threats, which are significant challenges for financial institutions.

Access to Advanced Technology

Cloud-based core banking services provide access to cutting-edge technologies, such as artificial intelligence, machine learning, big data analytics, and blockchain. These technologies empower banks to offer personalized services, improve risk management, enhance fraud detection, and optimize customer experiences.

Seamless Integration

Cloud-based services offer seamless integration capabilities, enabling financial institutions to connect with various third-party applications, FinTech partners, and digital platforms easily. This integration fosters innovation and enables banks to offer a comprehensive suite of services to their customers.

Improved Customer Experience

Cloud-based core banking services facilitate enhanced customer experiences by enabling anytime, anywhere access to banking services through multiple channels. Customers can access their accounts, make transactions, and avail banking services conveniently on their preferred devices, leading to higher customer satisfaction and loyalty.

Regulatory Compliance

Cloud service providers adhere to strict security and compliance standards, ensuring that financial institutions stay compliant with industry regulations and data protection laws. This helps banks avoid penalties and legal complications related to data breaches and non-compliance.

Conclusion

The advent of cloud-based services has revolutionized the core banking system, empowering financial institutions with greater agility, cost-effectiveness, and scalability. Digital core banking solutions offered by leading providers have enabled banks to provide superior customer experiences while staying ahead in an increasingly competitive landscape. As the banking sector continues to embrace this paradigm shift, we can expect further advancements in technology and a brighter, more connected future for the financial industry. Embracing the cloud-based revolution, banks are well-positioned to meet the demands of the modern consumer and thrive in the ever-evolving world of finance.

The paradigm shift of core banking towards cloud-based core banking services is driven by the need for cost-effectiveness, scalability, flexibility, faster innovation, enhanced security, improved customer experiences, seamless integration, and regulatory compliance. At MobiFin, we have embraced this change and have strategically moved towards cloud-based solutions which will allow us to be competitive, agile, and customer-centric in the dynamic and highly competitive banking industry.