Case Studies

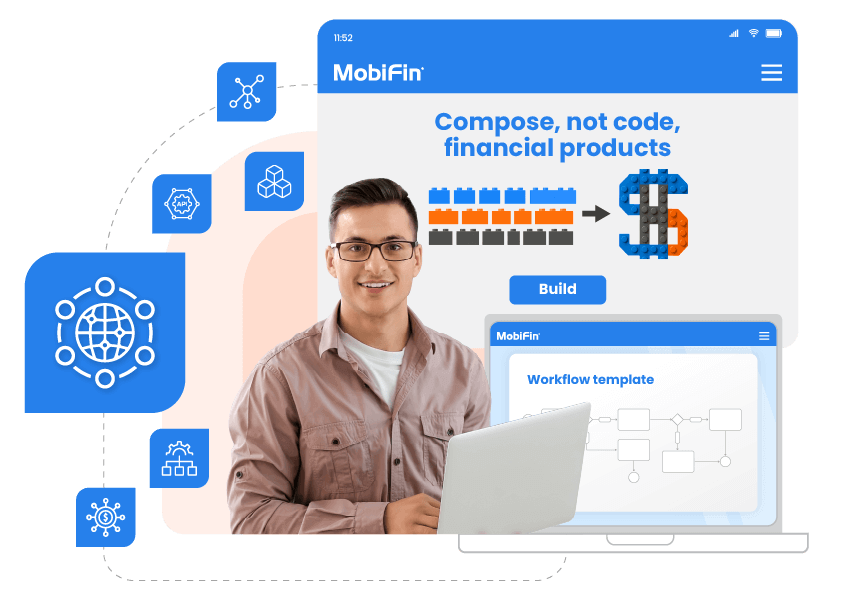

Compose and launch fintech innovation with unmatched speed and agility

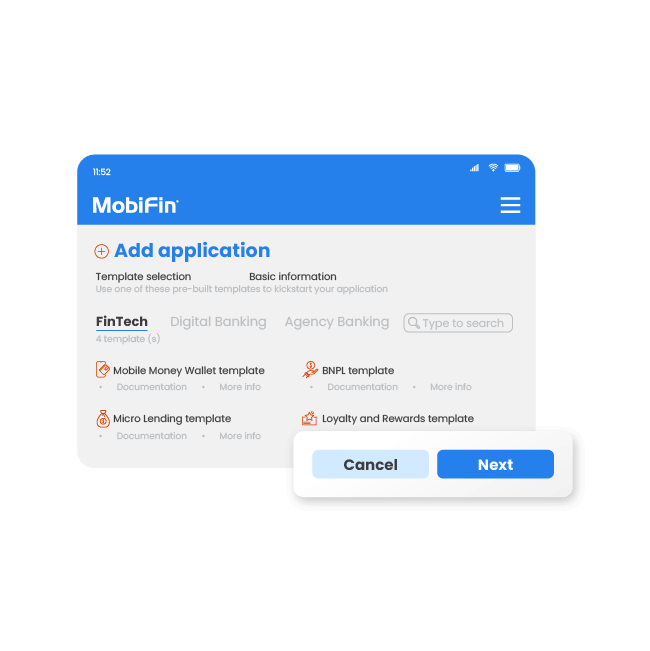

Pre-built fintech templates

Tapestry offers a vast library of pre-built templates that capture the most critical fintech workflows. Built on decades of expertise, they can be tailored to your exact requirements, giving business teams a head start to innovate, accelerate time-to-market, and launch with confidence - without writing a single line of code.

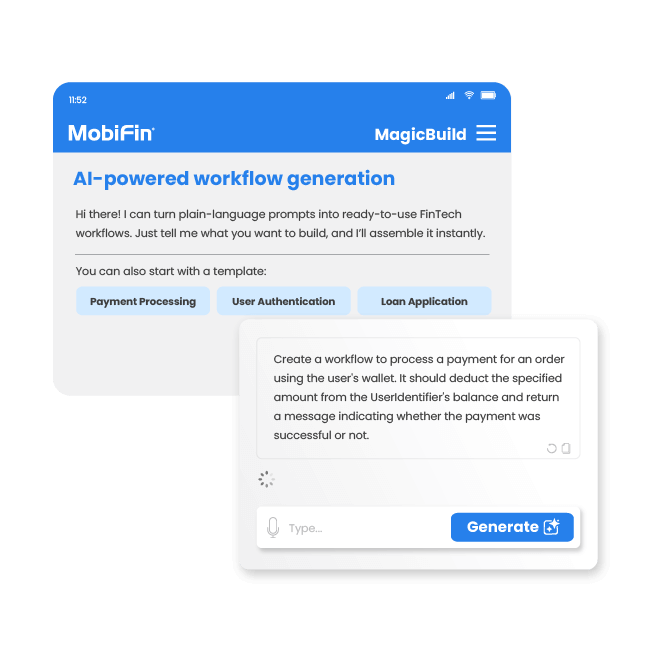

AI-powered workflow generation

Tapestry Magic Build puts AI-powered workflow creation in the hands of business users. Users just describe what they want in plain language, and the platform instantly assembles the right building blocks. From stitching together entire products to generating brand-new workflows, or refining existing ones, Magic Build makes it effortless. NLP-driven prompts eliminate developer bottlenecks, enabling true self-service. This results in faster launches, cleaner customization, and a direct path from idea to market.

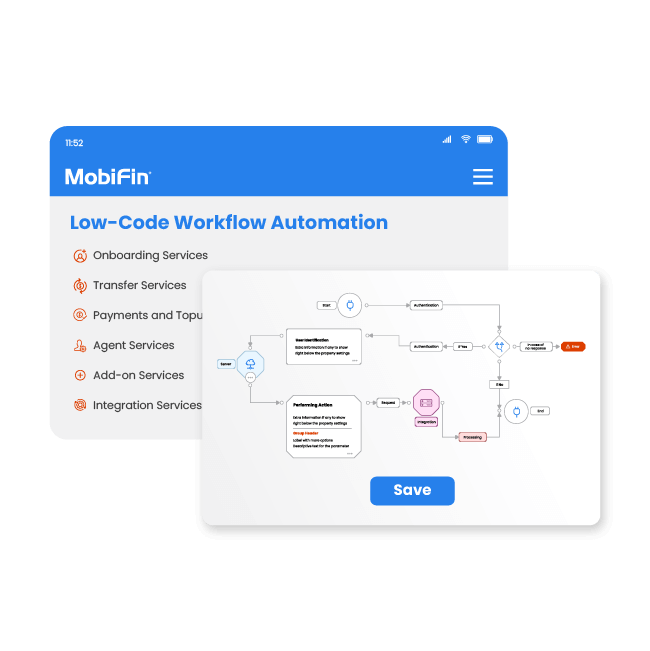

Drag-and-drop workflow automation

Prefer to take the wheel after Magic Build?

Tapestry’s low-code, drag-and-drop builder lets business and ops teams visually assemble and refine workflows from templates - no more dev tickets. Users map logic and branches, add approvals and data mappings. They simulate edge cases and run live tests with versioning and guardrails and ship confidently with instant updates, auditability, and zero code.

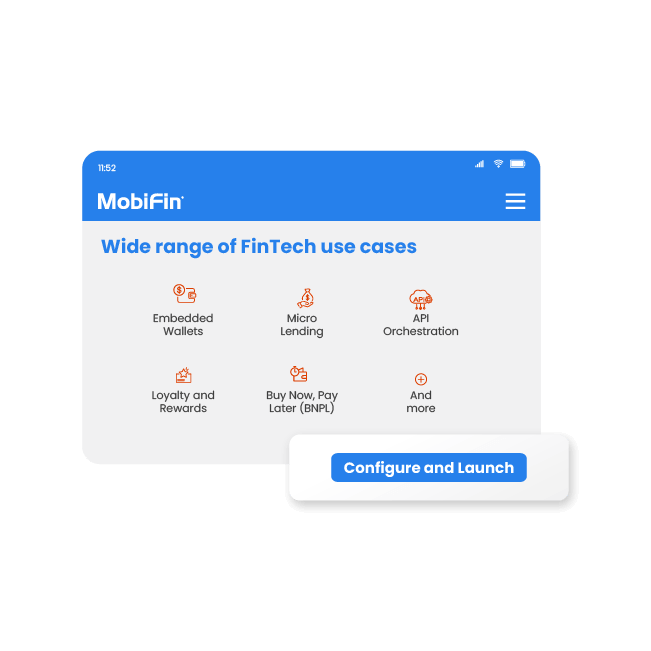

Wide range of fintech use cases

From core financial products to next-generation embedded experiences, Tapestry enables businesses to tailor and launch a wide range of fintech use cases. Whether wallets, lending, rewards, or API orchestration, the platform makes everything simple. Users can assemble, customize, and scale differentiated offerings with unmatched speed and precision.

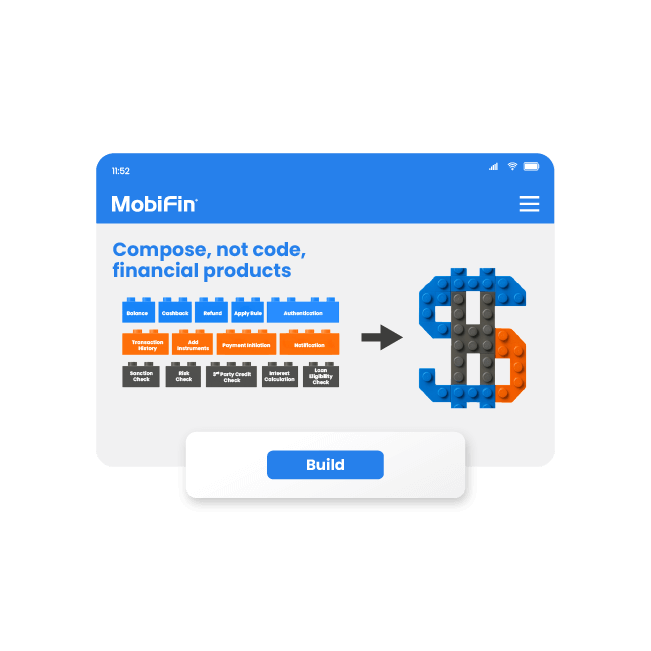

Composable fintech primitives

At its core, Tapestry is powered by independent and interoperable fintech primitives such as interest logic, cashback rules, and transaction limits. These reusable building blocks can be extended and combined across products and partners, enabling rapid iteration and a true “build once, scale anywhere” model. This plug-and-play approach eliminates redundant code, boosts innovation, and keeps your financial logic consistent across use cases.

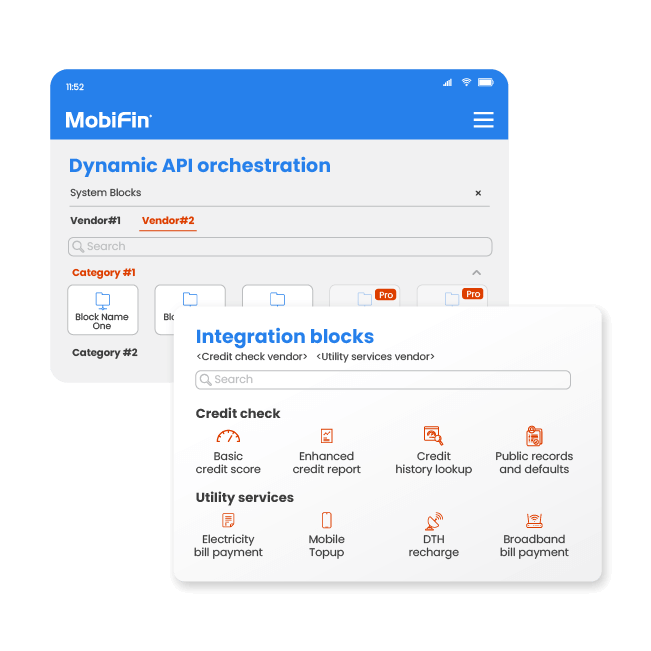

Dynamic API orchestration

Tapestry connects to existing stack by letting users import internal or third-party APIs as workflow components. Once composed, these flows can be exposed as secure, reusable APIs - ready to embed into your applications or partner channels. Built-in debugging, monitoring, versioning, and access controls give full API lifecycle ownership, without backend bottlenecks or vendor lock-in.

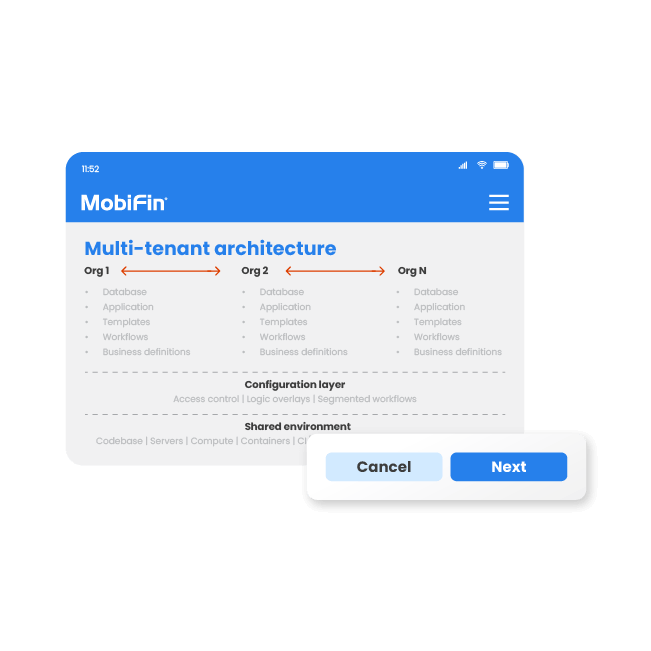

Multi-tenant architecture

Tapestry’s architecture supports multi-tenancy with shared environments, allowing organizations to configure once and deploy anywhere. Segmented and versioned workflow groups, tenant-specific logic overlays, and granular access controls enable safe reuse and scaling across business units, geographies, or customer segments. Enterprises gain efficiency and governance without sacrificing agility.

Frequently asked questions

Yes. Tapestry’s dynamic API builder ingests proprietary and third-party APIs, composes them into orchestrated workflows, and exposes them as secure services. This enables seamless integration with core systems, partner ecosystems, or external providers without vendor lock-in or costly custom engineering.

Absolutely. Tapestry’s API-first architecture and open API ingestion enable banks to expose, orchestrate, and reuse APIs. This provides the flexibility to plug into embedded finance journeys, comply with open banking mandates, and extend services into digital ecosystems.

The low-code builder empowers business teams to design, test, and simulate financial products via drag-and-drop workflows. It eliminates dependency on engineering for iterative changes, accelerating innovation while ensuring logic consistency and alignment with backend processes through embedded BPM intelligence.

By reusing modular primitives like cashback logic, interest rules, or transaction limits, teams avoid reinventing code. This composability eliminates redundancy, boosts development efficiency, ensures consistent behavior across products, and frees engineering resources for higher-value innovation initiatives.

Tapestry accelerates launches through pre-built fintech templates and a low-code flow builder, reducing development cycles. At the same time, embedded business rules, version control, and sandbox testing ensure regulatory compliance, safe experimentation, and confidence before moving into production.

With a built-in sandbox, institutions can simulate real-world conditions, perform mock testing, and validate logic before production. This reduces financial and operational risk, shortens feedback loops, and empowers teams to launch confidently with minimal disruption.

Tapestry’s multi-tenant architecture allows centralized configuration with tenant-specific overlays. Segmented workflows, granular access controls, and version management ensure governance, consistency, and safe scaling across units and geographies, while preserving flexibility to meet local regulatory and operational requirements.

Tapestry embeds controls like role-specific permissions, maker-checker workflows, audit trails, and data segregation into its framework. This ensures alignment with banking-grade security, regulatory expectations, and operational risk requirements, supporting both internal governance and external compliance standards effectively.

Versioned workflows allow cloning, rollback, and adaptation across deployments, ensuring controlled evolution. Institutions can standardize logic globally, adapt locally, and maintain visibility. This supports safe change management, reduces operational risk, and enhances agility in rapidly evolving financial ecosystems.

Tapestry is built on a MACH-aligned tech stack—Microservices, API-first, Cloud-native, Headless. This architecture ensures resilience, scalability, and interoperability, enabling banks to adapt quickly to new business models, regulatory changes, and customer demands without costly re-platforming.