Loan underwriting was once a complicated process, involving too many intricacies. Traditional methods of underwriting can be inefficient, exposing lenders to fraud risks and regulatory obstacles.

Such shortcomings leave financial institutions vulnerable to credit defaults, compliance failures, and financial misreporting. To address these challenges, financial institutions are resorting to AI in underwriting. It uses advanced algorithms and extensive data analysis to streamline the loan application process, resulting in 10.2% higher loan profits and 6.8% lower default rates.

This article takes a close look at the fundamentals of AI-driven underwriting and its scope in digital lending.

How AI transforms underwriting

Using AI in loan underwriting enables faster and more accurate lending decisions. It reduces human errors and ensures correct credit assessments. AI-driven underwriting connects structured data like credit scores and income with unstructured data like user behavior and digital footprint. To cite an example, digital lenders in Southeast Asia are leveraging smartphone usage patterns and utility bill payments to score thin-file borrowers who would otherwise be excluded.

AI underwriting platforms use parallel computing and rule-based decision trees to process large volumes of applications simultaneously. Lenders can handle massive increase in daily loan applications without expanding staff headcount.

Reimagined risk management with AI

AI models have auditable workflows and built-in rule sets in line with regulatory requirements like GDPR and Fair Lending guidelines. Globally, regulators are increasingly mandating explainability in AI credit models (such as the EU’s AI Act) making transparent design much more than compliance checkbox.

Every decision path supports internal audits and third-party reviews as it is registered with timestamped rationale and risk flags. It ensures model transparency and enables ongoing bias monitoring.

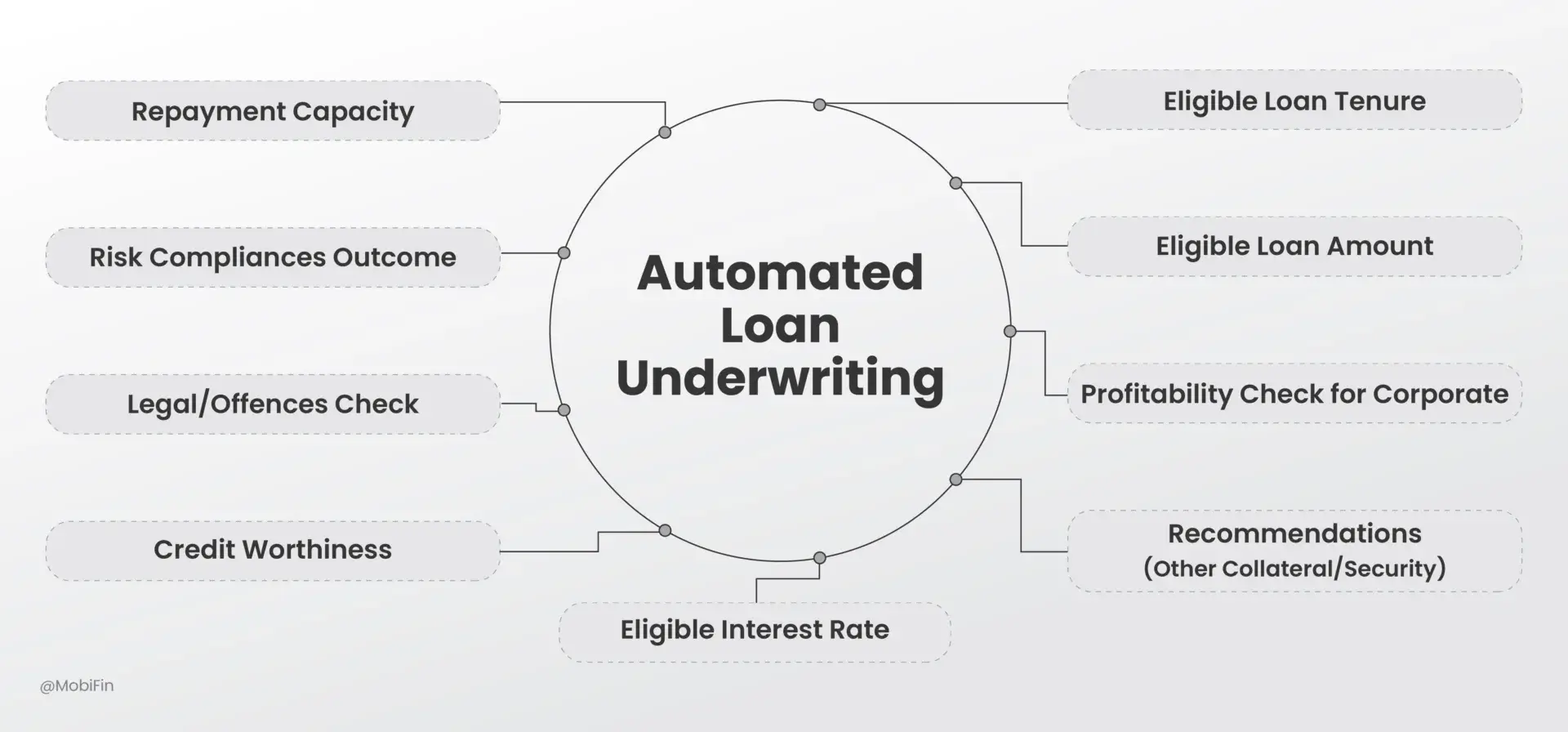

AI-driven underwriting determines the loan repayment capacity by using trained ML models. Modern scoring engines assign risk labels like low risk and medium risk based on the borrower’s behavioral patterns, regression models analyze factors like late payment frequency, debt-to-income ratio, and transaction anomalies to estimate default probability.

After the risk score generation, a rules engine approves, conditionally approves, or declines the application, based on the predefined lending thresholds. Approved decisions get pushed to the lender’s Loan Origination Systems (LOS) through an API or secure batch upload. This integration enables tracking of the application status in real-time, eliminates rework through manual data transfer, and shortens approval cycles.

Benefits

AI credit underwriting has several advantages across speed, accuracy, compliance, and scalability. They are:

Better customer experience

As AI eliminates multi-step manual reviews, it shortens the loan approval process to under 10 minutes for standard applications. Borrowers receive near-instant updates through integrated digital channels. It improves turnaround times and increases approval rate visibility at every stage of the journey.

Improved portfolio quality

Banks can use AI to enhance the accuracy of the lending-risk models and reduce non-performing assets. It helps in making better loan decisions by determining factors like debt-to-income ratios. This approach improves the portfolio quality and reduces late-stage defaults in personal loans.

Reduced non-performing loans (NPLs)

Non-performing loans have a huge impact on a lender’s bottom-line. They hamper profitability and lending capacity while increasing funding costs and regulatory capital requirements. AI-driven underwriting reduces high-risk credits by real-time monitoring, thereby reducing non-performing loans.

Greater financial inclusion for underbanked

Traditional underwriting relies mostly on salary slips, tax records, or credit scores. Underbanked and unbanked populations often have inadequate financial histories, making them invisible or “high-risk” in legacy models. Automated AI underwriting expands loan books into rural areas or untapped markets.

AI underwriting fosters long-term customer loyalty among first-time borrowers and drives financial inclusion without compromising compliance or risk.

Operational efficiency

OCR and NLP automate document collection, verification, and data extraction. This reduces manual data entry, minimizes errors and frees staff for higher-value tasks. AI-driven underwriting transforms operations from resource-heavy and error-prone to automated, scalable, and efficient. This allows lenders to grow faster while keeping costs predictable.

Lower costs of risk management

AI models analyze real-time transaction data, behavioral patterns, and anomalies. Fraudulent or high-risk applications are flagged before disbursal, preventing future losses. AI-driven underwriting provides more accurate risk segmentation with fewer false positives and rejections.

Governance and responsibility

In AI-driven underwriting, governance and responsibility are critical to balance innovation with compliance. Financial institutions must ensure that AI models adhere to lending regulations, maintain explainability, and provide audit trails so that every decision is transparent and traceable. Bias detection and fairness testing prevent discriminatory outcomes and support financial inclusion, while human oversight remains vital for high-risk or borderline cases to ensure fairness and accountability. By embedding compliance, explainability, bias controls, and human checks into AI workflows, lenders can harness the speed and accuracy of automation without compromising trust, regulatory alignment, or borrower confidence.

Future of AI-driven underwriting

The future of AI in lending is moving far beyond its current role in credit decisioning. Embedded AI will become integral to the entire lending lifecycle—capturing borrower intent, streamlining onboarding, enhancing underwriting, powering collections, and even shaping post-loan engagement. With deeper integration into open banking frameworks and access to alternative data ecosystems such as utility payments, e-commerce activity, and digital footprints, lenders can achieve a 360° view of customer profiles. This allows them not only to assess creditworthiness but also to anticipate repayment behaviors, identify early warning signals, and design proactive interventions.

As open finance ecosystems mature, underwriting may evolve from a single event into a continuous process. Borrower risk profiles will get dynamically updated in real time, enabling proactive interventions before defaults occur.

The focus will shift from transactional credit approvals to end-to-end customer risk management, where lenders balance growth, compliance, and resilience. By embedding explainable AI models that continuously learn from real-world borrower interactions, financial institutions can deliver faster, fairer, and more personalized credit experiences. They can also maintain transparency and trust in an increasingly regulated environment.

Wrap up

By combining structured and alternative data, AI enables fairer credit decisions, reduces operational inefficiencies, and strengthens risk management. However, its success depends on responsible adoption—balancing innovation with explainability, compliance, and human oversight. As embedded AI converges with open banking and alternative data ecosystems, lending will shift from transactional decision-making to holistic customer risk management. Institutions that embrace this transformation today will not only scale faster but also build deeper trust and long-term value in tomorrow’s digital financial ecosystem.

In the years to come, the leaders in digital lending will be those who treat AI underwriting not just as a technology upgrade, but as an enabler of reimagined risk, responsibility, and customer relationships.

In case you are looking to enrich your loan servicing and streamline the loan origination & management processes, we would be happy to help you.