The global economy is no longer defined solely by corporations, salaried jobs, or large-scale enterprises. A parallel economy driven by individuals monetizing their skills, creativity, and influence is rising fast. This “creator economy” spans social media influencers, YouTubers, podcasters, Twitch streamers, digital artists, online educators, writers on Substack, and independent solopreneurs.

Goldman Sachs projects the global creator economy to approach half a trillion dollars by 2027. Even more compelling for forward-looking fintech leaders is the growth trajectory in emerging markets. According to a report by VISA, Africa’s creator economy, valued at US$3.08 billion today, is projected to grow six-fold to $17.84 billion by 2030—a 28.5% annual growth rate. Asia Pacific’s creator economy reached US$135.2 billion in 2023 and is expected to grow at 30% CAGR by 2030, driven by a surge in digital-native professionals with flexible, borderless working patterns.

An opportunity for financial institutions

Traditional banks have largely overlooked the creator segment, primarily because their irregular income patterns and platform-driven models do not fit legacy product frameworks. Income irregularity, multi-platform earnings, cross-border transactions, and unique business models require banking tools designed from the ground up for monetization, speed, and flexibility. For C-suite leaders in fintech and banking, creator-focused banking is not a niche but the next growth frontier.

The unique financial needs of creators

Creators are not bound by a single employer, predictable payroll cycles, or local-only clientele. Their earnings and expenses often resemble the dynamics of micro-enterprises, but with even greater volatility and diversity. Their defining financial characteristic is irregular, platform-based income. Revenue flows from multiple channels including ad revenue, brand collaborations, merchandise sales, paid subscriptions, affiliate marketing, and digital product launches, with income timing and amounts fluctuating significantly.

These professionals also engage in multi-platform monetization, where a creator may earn from YouTube, Instagram, TikTok, Twitch, Patreon, Substack, Shopify, and more, within a single month. Without integrated tools, managing these diverse income streams becomes an operational burden. Additionally, creators might have cross-border earnings, with audiences in different geographies, earning in USD, EUR, GBP, or local currencies via diverse payment processors. High conversion fees and protracted settlement cycles eat into margins.

The creator economy also demands real-time payouts, as waiting weeks for payouts is a growth bottleneck. Creators need instant liquidity to reinvest in content, equipment, ads, or collaborations. These professionals also face significant challenges with credit access. Without salary slips or conventional employment proof, many creators face loan rejections despite healthy, consistent earnings from their platforms.

Bridging precedent from gig economy to creator economy

Early-mover neobanks such as Chime, N26, and Monzo built their initial momentum by serving freelancers and gig workers. These are the segments that traditional banks often neglected due to irregular income flows and limited credit history. By simplifying account opening, enabling faster payouts, and offering fee-free structures, these challenges proved that addressing non-traditional workers could drive rapid adoption and loyalty.

The creator economy represents the next logical evolution of this trend. Like gig workers, creators operate outside standard payroll cycles, but their financial lives are even more complex. They span multiple platforms, currencies, and business models. For fintechs and banks, this means the playbook that worked for freelancers must now be reimagined for creators, with a sharper focus on monetization, analytics, and cross-border liquidity.

Monetization-focused banking features for creators

To capture this opportunity, digital banking platforms must embed monetization tools directly into the core banking experience. It will enable creators to turn their diverse income streams into predictable, growth-ready financial ecosystems. This is where API-driven, modular offerings like MobiFin’s come into the picture.

Real-time platform payouts, enabled by direct API integrations with platforms such as YouTube, Stripe, Shopify, Patreon, and Twitch, eliminate the typical 30-60 day waiting period. They provide low-cost, compliant cross-border settlements.

Multi-source income aggregation dashboards provide creators with a unified view of all income streams, complemented by cash flow forecasting tools to anticipate seasonal dips and spikes. Advanced analytics help identify best-performing revenue sources, giving creators strategic insights into their earning patterns.

Tax management tools automate the complex process of managing creator finances through auto-tagging of income sources such as brand deals, ad revenue, and merchandise sales. These systems provide automated income tax estimation with quarterly reminders and generate exportable, accountant-ready income summaries for compliance and filing.

Creator-centric credit products leverage AI-driven income-based credit scoring using transaction and wallet history. These products offer instant micro-credit for equipment upgrades, campaign budgets, or travel, along with buy-now-pay-later options for subscriptions like Adobe Creative Cloud, Canva, or Zoom.

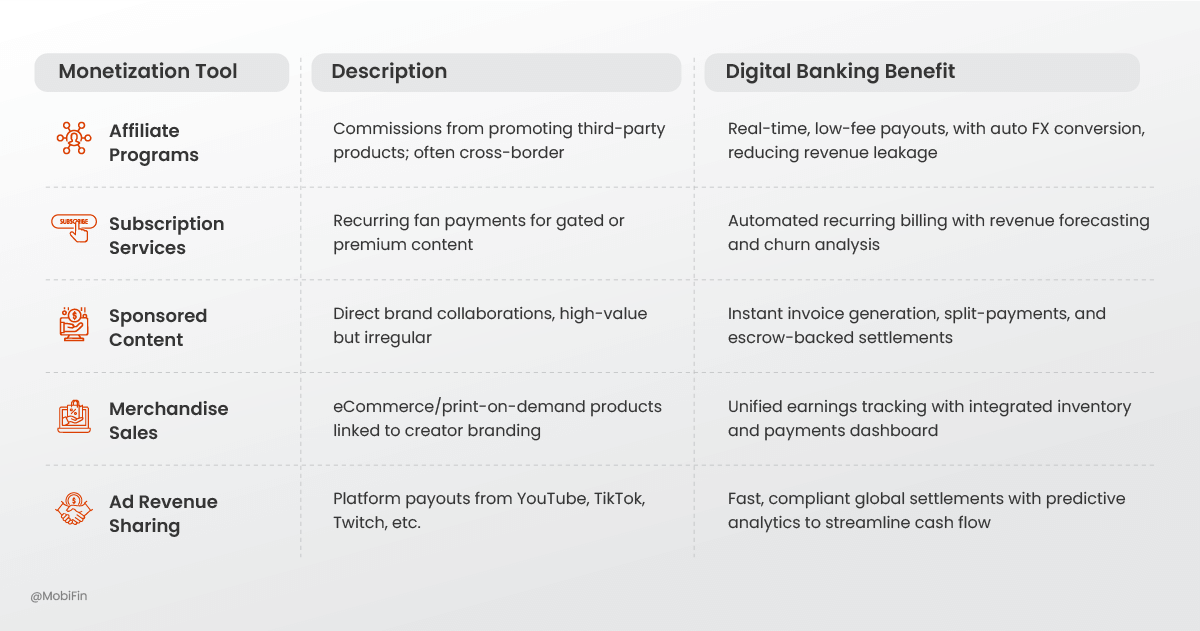

The table below outlines key monetization models in the creator economy and highlights the strategic value digital banking can deliver for each.

Business banking for solopreneurs in the creator space

While many creators operate as one-person businesses, they require enterprise-grade financial tools. These include integrated business accounts for issuing invoices, categorizing expenses, and managing budgets. Virtual cards become essential for platform-specific ad spends or subscriptions, while seamless foreign remittance and competitive currency conversion help manage global earnings. Plugins for accounting software like Tally, Zoho Books, or QuickBooks enable automated ledger updates, streamlining financial management.

Real-world use cases

Practical applications demonstrate tangible value propositions of creator-focused banking. In YouTube Creator Credit Enablement scenarios, a YouTuber earning $5,000 from AdSense gets a same-day loan offer via their banking app, enabling them to hire a video editor immediately for their next project. For NFT Artist Tax Automation, a digital artist selling NFTs receives an in-app alert estimating tax obligations after each sale, eliminating year-end surprises. Travel Vlogger’s Multi-Platform Sync cases show how a vlogger can link income from YouTube, Instagram, and Patreon, receiving a monthly P&L report with visual insights that help them identify the most profitable content type.

Why banks and fintechs should prioritize creators

The creator economy’s scale and growth rates make it a compelling segment for several key reasons. The market size and growth potential include over 300 million creators worldwide, representing the fastest-growing base in Africa and APAC. Revenue stickiness emerges because creators often maintain multiple accounts, making them long-term, high-engagement customers.

These professionals also offer high brand leverage, as creator clients become organic promoters of banking products they trust, providing built-in influencer marketing potential. Cross-sell opportunities automatically emerge, with upselling into savings, investments, insurance, and retirement planning becoming natural once income flows through the bank.

For leadership teams, the business case is clear: investing in creator-focused solutions is not just a diversification strategy but an acquisition strategy with built-in virality.

Conclusion

The next banking revolution will not be led by brick-and-mortar branches; it will be powered by digital infrastructure purpose-built for modern work identities. Creators, freelancers, and solopreneurs have evolved to be a global economic force.

Successful institutions will design monetization-first experiences, rather than retrofitting legacy products. In this ecosystem, MobiFin’s embedded digital banking solutions enable rapid innovation, giving banks and financial providers the ability to serve creators with speed, scale, and profitability.

MobiFin’s digital banking solution enables banks and fintechs to launch creator-focused products without the heavy lifting of building from scratch. Its modular, API-first architecture ensures payments and fund transfers are seamless, efficient, and scalable.

By embedding these capabilities into existing or white-label offerings, banks can enter the creator economy segment quickly and establish an early-mover advantage. They stand to gain as the preferred partner for a new generation of customers.

If you are looking to establish market leadership in the creator economy, connect with us to explore solutions that drive growth and long-term differentiation.