The global workforce is undergoing a seismic shift. The gig economy market across the world is projected to reach $455 billion by 2025. A CAGR of 17% highlights its rapid growth (Statista). Gig workers represent 30% of the global workforce (McKinsey). While gig platforms create income flexibility for millions, they also highlight a critical gap: traditional financial services aren’t built for irregular gig work models.

Traditional financial institutions focus on salaried individuals, leaving gig workers with unpredictable income, absent credit records, and fluid schedules underserved. Hence there’s a pressing need for digital-first, inclusive financial tools, designed for volatility and flexibility, which cater to the gig workforce.

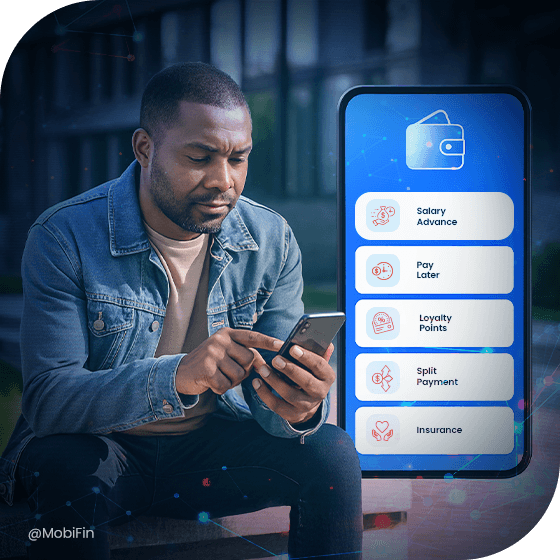

Enter Digital Wallets.

Digital wallet solutions are emerging as a critical tool in bridging this gap, offering accessible, secure, and real-time financial services for gig workers.

Salient Features of Gig-Focused Digital Wallet

Specialized digital wallets serve as centralized hubs for payments, micro-savings, credit access, insurance, and education. A thoughtfully designed gig wallet isn’t just a utility, it becomes an economic enabler. Some key features are:

- Instant payouts and earned wage access (EWA)

- Automated savings and emergency funds

- On-demand Micro-insurance for health and accidents

- Microloans and credit lines for limited-credit profiles

Designing wallets for the gig workforce

Things that make life easier for the users

To truly serve the gig economy, digital wallet solution providers need to go beyond traditional payments. The design must reflect empathy for irregular incomes, flexible schedules, and real-world budgeting behaviors.

Onboarding simplicity

A wallet that requires long forms or bank visits fails from the start. Most gig workers operate with minimal paperwork and often lack formal proof of income. Simplified eKYC (electronic Know Your Customer), mobile-first onboarding, and local language support are essential.

Auto-capturing IDs with smartphone cameras, facial recognition-based verification, biometric checks, and regional language onboarding flows drastically reduce friction.

Multi-currency and cross-border support

Global gig platforms like Upwork or Freelancer.com employ workers from every corner of the world. These workers need to receive international payments quickly and affordably.

Multi-currency wallets with dynamic FX conversion, stablecoin rails, and local bank settlement are crucial. Remote freelancers and migrant workers often earn in one currency and remit in another.

Payout automation and earned wage access

Fast access to earnings is one of the biggest motivators for gig workers. Hence, a digital wallet platform must integrate via APIs to support automated, real-time payouts directly from gig platforms.

Earned Wage Access (EWA) capabilities let workers withdraw part of their earnings instantly, thereby avoiding high-interest payday advances and financial stress.

Micro-savings and micro-insurance

Gig workers rarely have employer-sponsored savings or insurance. Built-in tools for round-up savings, goal-based deposits, and auto-sweep rules into savings buckets can build emergency buffers.

Additionally, wallets should integrate on-demand micro-insurance, ranging from daily health coverage to pay-as-you-go accident cover. These products must be low-cost, instant, and claimable digitally.

Embedded financial education

Financial literacy can be a growth lever. Wallets that integrate gamified education modules, personalized nudges, and spending insights can transform wallets into personal finance coaches.

Whether it’s setting a budget after every major payout or reminding users to save during good earning weeks, behavior-driven prompts can help users build positive habits.

Experience and interface considerations

Designing for the gig economy also means designing for performance across devices, bandwidths, literacy levels, and languages, to reach the last mile. User experience must be resilient, intuitive, and adaptable to real-world constraints, not ideal conditions.

Lightweight apps for low-bandwidth environments

Many gig workers operate in areas with unstable or low connectivity. Wallet apps must be lightweight and offline-friendly.

Progressive web apps (PWAs), offline transaction queuing, and low-data UIs can ensure uninterrupted access on budget smartphones.

Intuitive, low-literacy UI design

For last-mile users, interfaces must be icon-driven, visually intuitive, and avoid financial jargon. Simple visual metaphors (like piggy banks for savings) and regional graphics can improve usability across literacy levels.

Localized UX and workflows

Parameters like language, currency, and preferred workflows vary across geographies. The wallet experience must reflect localized UX patterns, calendar formats, and cultural payment norms (e.g., mobile money in East Africa, QR payments in India).

Operational and regulatory challenges

Scaling gig wallets demands overcoming complex operations, integrations, and a maze of global regulations.

Platform partnerships and fragmentation

The gig economy is fragmented across thousands of platforms — ride-hail, delivery, freelance, home services, and more. Each platform has its own data models, APIs, payout schedules, data specs, and operational rules, making universal integration a heavy lift.

Digital wallet software faces technical challenges in integrating disparate APIs at scale, maintaining data integrity, and syncing payout windows, especially when gig workers juggle 3–5 platforms. A robust middleware, clear SLAs, and ongoing support become critical factors.

Trust, security, and KYC complexity

Trust is paramount, especially when handling earnings. But KYC and fraud risk management are complex in regions with weak identity systems.

Digital Wallets for gig workers must combine biometric onboarding, alternative ID sources (like telecom data or platform ratings), and fraud detection algorithms. In regions with poor ID infrastructure, verifying user identity without excluding genuine users is a significant challenge.

Multi-factor authentication, in-app alerts, and real-time fraud monitoring are must haves to prevent identity theft and app-based scams.

Compliance and cross-border licensing

Digital wallet regulation is fragmented globally. Some countries treat e-wallets as banks, others as payment processors, and many impose restrictions on cross-border flows.

Wallet providers must secure e-money licenses, comply with AML/CTF mandates, and adhere to data residency laws. This creates operational overhead, especially for multi-country launches.

Capturing transaction data can trigger GDPR, PDPA, or local privacy rules, so wallet providers need airtight data governance.

Success stories and growth opportunities

Real-world use cases

Leading platforms across the world showcase the potential of gig-wallets:

- GCash (Philippines)

GCash has integrated with local gig platforms to facilitate real-time earnings, while offering in-app savings, micro-investments, and insurance bundles. Their GSave and GInsure features have gained traction among gig workers and micro-entrepreneurs.

- M-Pesa (Kenya)

Originally designed for peer-to-peer payments, M-Pesa now supports gig use cases like last-mile delivery payouts, micro-credit, and digital merchant accounts. Its widespread availability on mobile phones makes it a preferred tool for both urban and rural earners.

- GrabFin (Southeast Asia)

Grab’s embedded wallet, GrabFin offers EWA (Earned Wage Access), along with options for buy-now-pay-later, insurance, and auto-saving goals right inside the driver app. By bringing financial services into a work platform, GrabFin tightly integrates earnings and money management.

Strategic benefits for banks and FinTechs

Serving gig workers is more than a CSR initiative; it’s a strategic opportunity. Here’s how banks can benefit from gig worker wallets:

Unlock millions of unbanked users

By offering a low-barrier, mobile-first wallet experience, banks and FinTechs can bring financial services to individuals who have previously been excluded due to lack of credit history or formal documentation. This expansion not only grows the addressable market exponentially but also fosters economic empowerment by enabling users to save, transact, and build credit for the first time.

Boost stickiness with integrated services

Embedding features like earned-wage access, micro-savings, and insurance directly into the wallet creates a one-stop hub that users rely on daily, strengthening engagement and reducing churn. As customers deepen their relationship through tailored financial tools, such as automated goal-based deposits or in-app credit offers, they become more likely to stick with the platform for multiple needs.

Leverage transaction data for risk modeling and personalization

Analyzing granular wallet activity, be it spending patterns, income flows, or savings behavior, gives wallet providers richer insights to build dynamic risk models that extend credit more accurately and responsibly. Moreover, personalized offers, nudges, and financial-health recommendations driven by real-time data can boost user satisfaction and drive higher lifetime value.

Enhance ESG and brand reputation through financial inclusion

By proactively serving underbanked and gig-economy workers, organizations demonstrate a genuine commitment to social impact and responsible growth, strengthening their ESG credentials. This visible dedication to financial inclusion resonates with customers, investors, and regulators alike, elevating brand trust and creating a virtuous cycle of positive reputation and new business opportunities.

Conclusion

The gig economy reflects a fundamental shift in how the world works. And yet, the financial infrastructure supporting this shift remains inadequate for millions. Digital wallets, when thoughtfully designed, offer an unparalleled opportunity to bridge this gap.

To succeed, solutions must be inclusive over exclusive, adaptive over rigid, and empowering rather than extractive.

As the ecosystem of banks, FinTechs, regulators, and platforms align, the opportunity lies not just in capturing a market, but in uplifting a generation. A well-engineered digital wallet for the gig worker is more than a product; it is a financial passport to a more stable, secure, and empowered life.

If you are looking for digital wallet solutions for gig workers, just get in touch with us and we would be happy to help you out.

Book a demo and connect with our experts.