What is the Concept of Gamification?

Gamification involves applying game-like elements to non-game contexts, such as digital payments platform. By adding rewards, challenges, and achievements, businesses can make their services more engaging and motivate users to take specific actions. This approach has been used in various industries, from healthcare to education, and has proven effective in improving user engagement and behavior.

Below are some FinTech gaming practices to level up the payments game:

Avatars

To provide an authentic and unique gaming flavor, Avatars provides users to create their profile to include their traits. Avatars can be a fun way for a user to create their first-time profile, shift from a different platform, or any user who has earned other badges due to increased points. These would turn a traditional wallet into a fun-based digital payments platform mechanism.

Challenges and Competitions

These can be used to encourage user engagement. This can include virtual scavenger hunts or quizzes that users can complete to earn rewards or advance in the app. These challenges can be tailored to different user segments, providing a personalized experience for each user and providing user motivation to move to the following levels and earn more.

Augmented reality (AR)

Augmented reality is a technology that overlays digital elements in the real world. This is one step ahead of gamification. In the context of e-payments, AR can be used to create an immersive and interactive experience for users. For example, a user entering any store could scan the QR of specific products through the Service Providers’ app, play games and answer simple questions for it, get vouchers, and make payment. This leads to a spike in user traffic on the payments platform.

Polls

Introducing polls in any app can provide benefits both for customers and for the organization. While for a customer, it makes them feel obliged that their views are taken up, for service providers, it can work as an excellent tool for Product Analysis.

Interactive Tutorials

Interactive tutorials can be used to teach users how to use the app in a fun and engaging way. For example, a digital wallet app could use a gamified tutorial to teach users how to make a payment, with each step of the process being turned into a mini-game.

Social Element

Social elements are becoming increasingly popular in digital wallet gamification. This can include things like leaderboards or social sharing features that allow users to share their achievements with friends and family. Service providers can increase user engagement and loyalty by creating a sense of community around the app.

Virtual Currencies

Another way that gamification is being used in digital payments is through virtual currencies. Some apps now allow users to earn and spend virtual currencies, which can be used to purchase goods and services within the app. Virtual currencies can also be used to incentivize certain behaviors, such as referring friends to the app or completing specific actions within the app. By rewarding users for these actions, businesses can increase user engagement and drive the adoption of their services.

MobiFin Gamification

Many digital payments platform now offer rewards programs that incentivize users to make purchases using the app. For example, users may earn points for each transaction they make, which can then be redeemed for discounts or other rewards. By using these platforms, users can not only save money on their purchases but also track their spending more easily. This can help users better understand where their money is going and make more informed financial decisions. Additionally, the convenience of digital payments can make it easier for users to stick to their budget and avoid overspending.

MobiFin is a state-of-the-art digital payments platform offering a comprehensive range of FinTech services through a single platform that has deployed its services with major telcos, banks, and FinTech companies around the world.

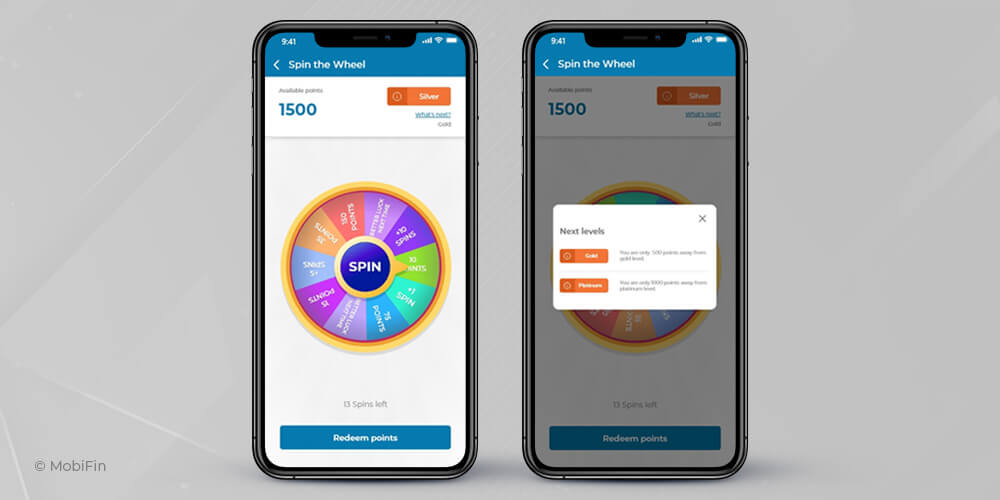

Apart from its complete suite of services, MobiFin stands out by incorporating interactive gamification features, such as Spin the Wheel, Scratch Cards, and Redeem Points, into its app and web platforms.

Both new and existing MobiFin users are rewarded for various transactions and activities, such as top-ups, bill payments, merchant payments, and increasing their KYC levels through the app. These rewards come in the form of spins and loyalty points that can be redeemed for e-money and other exciting rewards.

Gamification creates an engagement-led and intriguing interface that strengthens any app on the roadmap of including services at a broader level and becoming a super app from a single app.

MobiFin’s gamification element not only makes the payment process more enjoyable and engaging but also provides an additional layer of security and privacy.

Future Outlook

Looking to the future, it is likely that gamification will continue to play an important role in the world of digital payments. As technology continues to advance and users become more accustomed to personalized and interactive experiences, service providers will need to find new and innovative ways to keep their apps engaging and relevant, along with adding relevant layers and levels to keep user motivation high and user engaged in the entire journey. Read more about How is PaaS Shaping The Future of Digital Payments?

Additionally, as the use of mobile devices and mobile payments continues to grow, gamification will become an even more important tool for service providers looking to stand out in the crowded digital wallet market.

However, it is necessary to note that gamification should not be seen as a magic solution to all financial problems. It is still important for users to have a solid understanding of financial concepts and make informed decisions about their money. Additionally, businesses must ensure that their gamification strategies are ethical and transparent and do not encourage users to engage in risky or harmful behaviors.

Overall, gamification is a powerful tool for service providers looking to create engaging and enjoyable user experiences in their payment ecosystem. By incorporating game elements into their apps, service providers can increase user engagement, retention, and increased app-time, ultimately leading to increased revenue and a more successful business.