Why cash economies struggle to adopt digital-only financial models

The hardest last mile challenge for digital financial inclusion is cash-dominated economy. Large population segments continue to operate almost entirely in cash despite the expansion of digital payment rails and mobile connectivity. As traditional branch expansion is capital-intensive, gradual, and geographically limited, it becomes difficult to reach dispersed or rural communities at scale. It is equally challenging to convert cash-reliant populations into active users of digital-only financial models owing to trust gaps, onboarding friction, and limited access to smartphones or reliable data connectivity.

In many of these markets, the challenge is not merely technological readiness, but lived habit. Cash is woven into how people earn, spend, save, and help one another. Financial behavior is shaped by routine and familiarity rather than user interfaces or features. Banking models that overlook this reality often find it difficult to become part of everyday financial life in these segments, even when the underlying technology is sound.

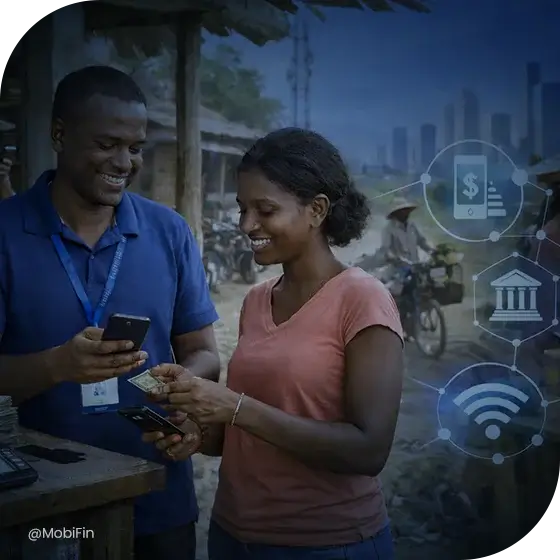

Agency banking has turned out to be a proven solution that brings together cash, trust, and digital finance. By amalgamating physical access and digital infrastructure, agency banking resolves the structural limitations of traditional banking as well as app-only financial services. It paves new avenues for inclusive financial ecosystems.

Defining cash economy

A cash economy is identified by a high reliance on physical cash for daily transactions like payments, savings, and informal lending. Formal banking infrastructure leaves rural and semi-urban populations underserved or entirely excluded. In such environments, informal savings groups, cash-based lending, and person-to-person cash payments are deeply embedded in everyday life.

In cash economies, trust if often built through familiarity, People trust individuals they see daily – like shopkeepers or community agents – more than distant financial institutions. This social reassurance explains why services delivered through these local intermediaries gain traction much faster than self-service digital models, especially among new users. For these customers, the human element is just as critical to adoption as the product’s actual features.

The limitations of digital-only models in cash markets

Digital-only financial models encounter structural challenges in cash economies. There is a discrepancy in smartphone ownership, data affordability, and Internet penetration. Thus, it limits access to app-based financial services. Even if devices are available, trust gaps persist with fully remote, self-service financial service models, particularly among first-time users.

Furthermore, onboarding friction and documentation barriers restrict adoption, particularly in regions with limited formal identification coverage. Persistent cash-in and cash-out dependency outside the formal system undermines digital wallet usage. Without accessible points to convert cash into digital value and vice versa, digital-only models see early curiosity but struggle to gain sustained traction.

How agency banking works in cash-dominant markets

Agency banking fills these gaps with a distributed operating model. At its core, agency banking enables third-party agents to serve as extensions of regulated financial institutions. These agents provide essential services such as withdrawals, deposits, transfers, bill payments, and assisted onboarding and KYC.

Agents serve as trusted local touchpoints for customer education and support, enabling first-time usage of digital wallets and facilitating cash digitization through cash-in and cash-out services. By embedding financial access within familiar community environments, agency banking reduces both psychological and logistical barriers to adoption.

What makes this model effective is consistency of experience. When people know that services will be available at the same place, from the same person, with predictable outcomes, confidence builds over time. This sense of continuity is often what turns first-time use into repeated use.

Building a transaction network through agents

Agency banking replaces centralized branches with distributed transaction points. These points are built for efficient management of high-frequency, low-value transactions reflecting the realities of cash-based economies. Through agent banking network, financial services expand into rural and semi-urban regions at scale without the overhead of traditional infrastructure.

Network density becomes a critical driver of adoption, directly influencing trust, accessibility, and repeat usage. The closer and more visible agents are to customers’ daily lives, the more likely users are to engage regularly with digital financial services.

What it takes to scale agency banking beyond pilot deployments

Scalable agency banking needs strong operational foundations. Agent onboarding and lifecycle management ensure compliance, quality, and sustained performance across the network. Liquidity and float management are essential for maintaining uninterrupted service, particularly for cash-heavy transactions.

Transaction reliability and uptime are non-negotiable, as failures directly erode trust. Transparent commission calculation and settlement mechanisms are equally important, ensuring agents remain economically motivated and aligned with institutional objectives.

As agent networks grow, the challenge shifts from access to consistency. Users expect the same experience regardless of location or timing, while agents need clarity and predictability to serve customers with confidence. Maintaining this balance is what allows agency banking to remain reliable as it expands.

Risk, fraud, and trust in agent-led models

Agent-led models present certain risks related to cash handling, agent misuse, and operational fraud. They can result in identity fraud and account misuse in case onboarding controls are not properly enforced. As transaction volumes increase, monitoring activity at the agent level becomes critical.

It is possible to reduce these risks by employing effective controls, limits, and audit mechanisms. Hence, trust in agency banking systems can be sustained through visibility, accountability, and consistent enforcement of operational standards.

How these risks are addressed also shapes broader confidence in the model. Clear accountability and transparent practices help communities, partners, and regulators view agent-led banking as a legitimate extension of the formal financial system rather than an informal workaround.

Regulatory role in enabling agency banking

Regulatory frameworks play a crucial role in enabling agency banking in emerging markets. Clear guidelines around agent authorization, KYC delegation, and assisted onboarding create operational certainty for financial institutions. Regulators also define reporting, supervision, and audit requirements that ensure transparency and systemic stability.

Balancing financial inclusion with systemic risk control is essential. Well-designed regulations allow branchless banking solutions to scale along with maintaining safeguards against fraud, money laundering, and operational abuse.

From transactions to digital behavior

Agency banking often begins with cash-in and cash-out services as the primary bill entry point. Over time, users gradually transition to digital-only payments and transfers as familiarity increases. Habit formation is reinforced through recurring use cases such as payments, remittances, and peer-to-peer transfers.

Early adoption and wallet stickiness are strongly influenced by agent proximity. As users transact more frequently, data trails are generated, enabling financial profiling and deeper engagement with formal financial services.

How agency banking works to expand the ecosystem beyond payments

Once a transaction base is established, agency banking ecosystems expand beyond payments. Services such as utility bill payments, airtime top-ups, and merchant payments become common extensions. Governments increasingly use agent networks for disbursements and collections.

Micro-savings, credit, and insurance products can also be distributed through these networks, with agents serving as acquisition and servicing points rather than credit decision makers. Platform-led expansion is enabled by transaction data and behavioral signals, allowing institutions to tailor offerings responsibly.

Technology as the invisible enabler

Technology forms the scaffold for the entire agency banking model. Agent applications and dashboards enable transaction execution and monitoring in real time. Behind the scenes, real-time ledger, settlement, and reconciliation systems ensure accuracy and transparency.

Offline and low-bandwidth transaction support is critical in connectivity-constrained environments. Monitoring, analytics, and operational controls provide institutions with visibility into network health, risk exposure, and performance trends.

Measuring impact and ecosystem maturity

Impact measurement is a lot more than raw transaction growth. Active user growth is a clear sign of sustained adoption. Agent productivity, liquidity health, and churn rates reflect operational strength.

A reduction in cash dependency and migration toward fully digital use cases indicate ecosystem maturity. Together, these metrics determine whether agency banking is evolving into a durable digital ecosystem.

Common risks of agency banking deployments

Many deployments fail due to underinvestment in agent operations and support. Misaligned performance metrics, incentive structures, and commission models weaken agent motivation. Inadequate liquidity and float planning lead to service interruptions.

Weak fraud and compliance controls expose networks to reputational and regulatory risk. Treating agency banking as a one-time rollout instead of a continuous operating model undermines long-term sustainability.

The phased journey from cash economy to digital ecosystem

In most successful deployments, the shift from cash to digital does not happen all at once. It unfolds gradually, as people test, adapt, and build confidence at their own pace.

The transition from a cash economy to a fully functioning digital ecosystem follows a phased progression rather than a single leap. Each phase helps in combating a distinct behavioral, operational, and infrastructural barrier, and success in later stages depends entirely on the stability of the earlier ones.

Phase one is about cash access and digitization. At this stage, the primary objective is accessibility. Agency networks facilitate reliable cash-in and cash-out services, allowing users to safely convert physical cash into digital value and back. Trust is established by consistent availability, proximity of agents, and predictable transaction experiences. This phase legitimizes digital finance in cash-first environments by making it practical rather than aspirational.

Phase two focused on adoption of digital payments. After users are comfortable transacting digitally via agents, the emphasis is on reducing cash dependency. Recurring use cases like bill payments, domestic remittances, and peer-to-peer transfers encourage users to keep funds within wallets for longer durations. Habit formation becomes the key outcome. It is supported by ease of use, transaction reliability, and immediate value realization.

Phase three expands ecosystem services. With a stable transaction base, the ecosystem moves beyond payments into adjacent services. Utility payments, merchant acceptance, government disbursements, micro-savings, insurance distribution, and contextual credit offerings are layered onto the platform. Agents continue to act as access and support points, while platforms leverage transaction data to personalize offerings without introducing excessive risk.

Phase four enables data-driven financial inclusion. At maturity, transaction histories and behavioral data allow formal financial profiling. This lets institutions extend responsible credit, savings, and protection products tailored to real usage patterns rather than static demographics. Financial inclusion shifts from basic access to meaningful participation in the formal economy, supported by data-driven decisioning and regulatory oversight.

Each phase builds on the previous one, requiring operational discipline and strategic consistency. Skipping stages or overloading the ecosystem prematurely often leads to user drop-off, agent fatigue, and decline in customer trust. Sustainable digital ecosystems emerge through steady, well-sequenced progress rather than rapid digitization.

Conclusion

Agency banking model provides a practical bridge between cash economies and digital finance. Its success depends less on reach and more on operational discipline, risk controls, and regulatory alignment. When executed correctly, agency banking evolves from a transaction network into a foundation for inclusive digital ecosystems.

The long-term value of agency banking lies in its ability to fit naturally into how people already manage money, while gradually expanding what becomes possible. When trust is preserved and experiences remain consistent, agent networks evolve from access points into anchors of inclusive digital ecosystems.

If you are curious to learn more about agency banking and how it can help you out, reach out to our experts.