Across the globe, more than 1.4 billion adults remain outside the reach of traditional lenders because they lack formal credit histories. For banks and financial institutions, this absence of data signals risk; for the unbanked, it’s a locked door. Without credit reports, income statements, or collateral, millions of people are automatically excluded from accessing loans, even if they have a proven ability to repay.

Digital wallets are now changing that equation. Once seen only as convenient payment tools, digital wallet solutions are quickly becoming a gateway to credit scoring for populations traditional banks have long overlooked. By capturing everyday transaction patterns and spending behavior, they generate an entirely new class of credit intelligence — one built on real-time financial activity rather than past records and documents.

Limitations of traditional credit scoring

The standard credit scoring model is built on three pillars: formal documentation, historical repayment records, and bureau-verified data. While effective in structured economies, this model has significant blind spots in regions with high levels of informal labor and cash-based transactions.

Salaried employees with payslips and tax returns are the benchmark, leaving informal earners invisible. Street vendors, small traders, and gig workers often operate outside formal banking rails, even when financially responsible. Many unbanked individuals participate in community savings groups or informal lending circles, demonstrating strong repayment potential without any traceable record.

This creates a paradox: the people who need the maximum access to credit to grow their livelihoods are least likely to get it.

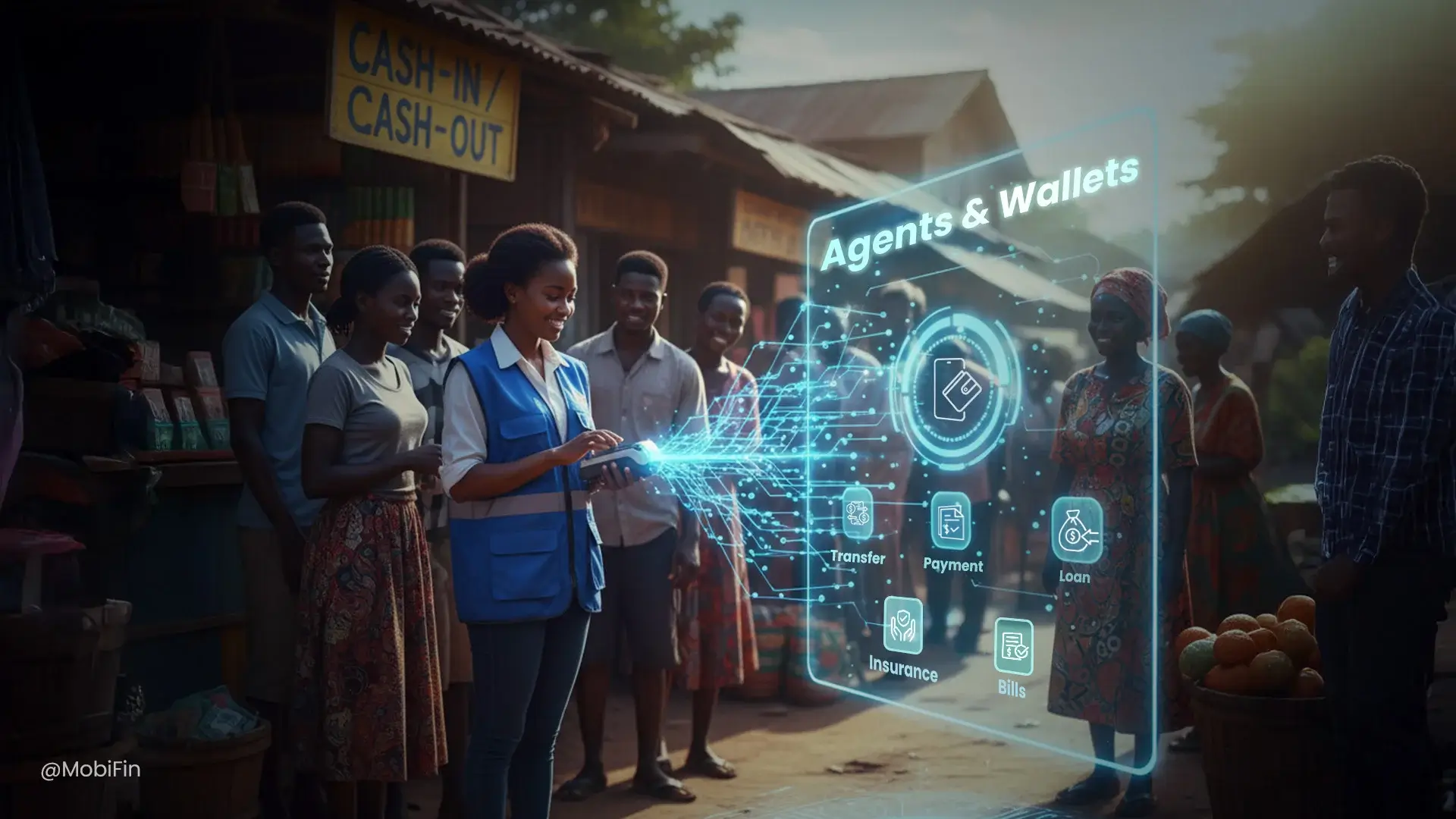

Digital wallets offer a breakthrough. By recording everyday financial interactions like utility payments and micro-savings, they create a dynamic, data-rich alternative to bureau-driven scoring. This turns a previously invisible population into a segment that can be served with confidence.

The transition to wallet-based behavioral scoring

What is behavioral scoring?

Behavioral scoring uses transactional signals and spending patterns to assess creditworthiness, rather than relying on traditional credit files or collateral. It shifts the focus from past financial identity to present financial behavior.

Key wallet activity signals

Wallets capture granular data that can paint a clear picture of financial habits:

- Top-up frequency and volume: Steady inflows indicate income stability.

- Merchant QR and utility payments: Show responsible bill management and payment consistency.

- Peer transfers and remittances: Reflect liquidity and social financial networks.

- Micro-savings or recurring deposits: Signal discipline and risk awareness.

- Repayment of wallet-linked loans: Builds a trust marker over time, even with small amounts.

The role of AI and data modeling

Artificial intelligence enhances these raw signals by spotting patterns humans can’t. AI models can cluster users into micro-segments based on spending and repayment behavior. They can not only flag anomalies or risk triggers in near real-time but also power instant decision engines for nano-loans or pay-later services.

For lenders, this means real-time credit decisioning without lengthy applications or paper trails, enabling scale and cost efficiency.

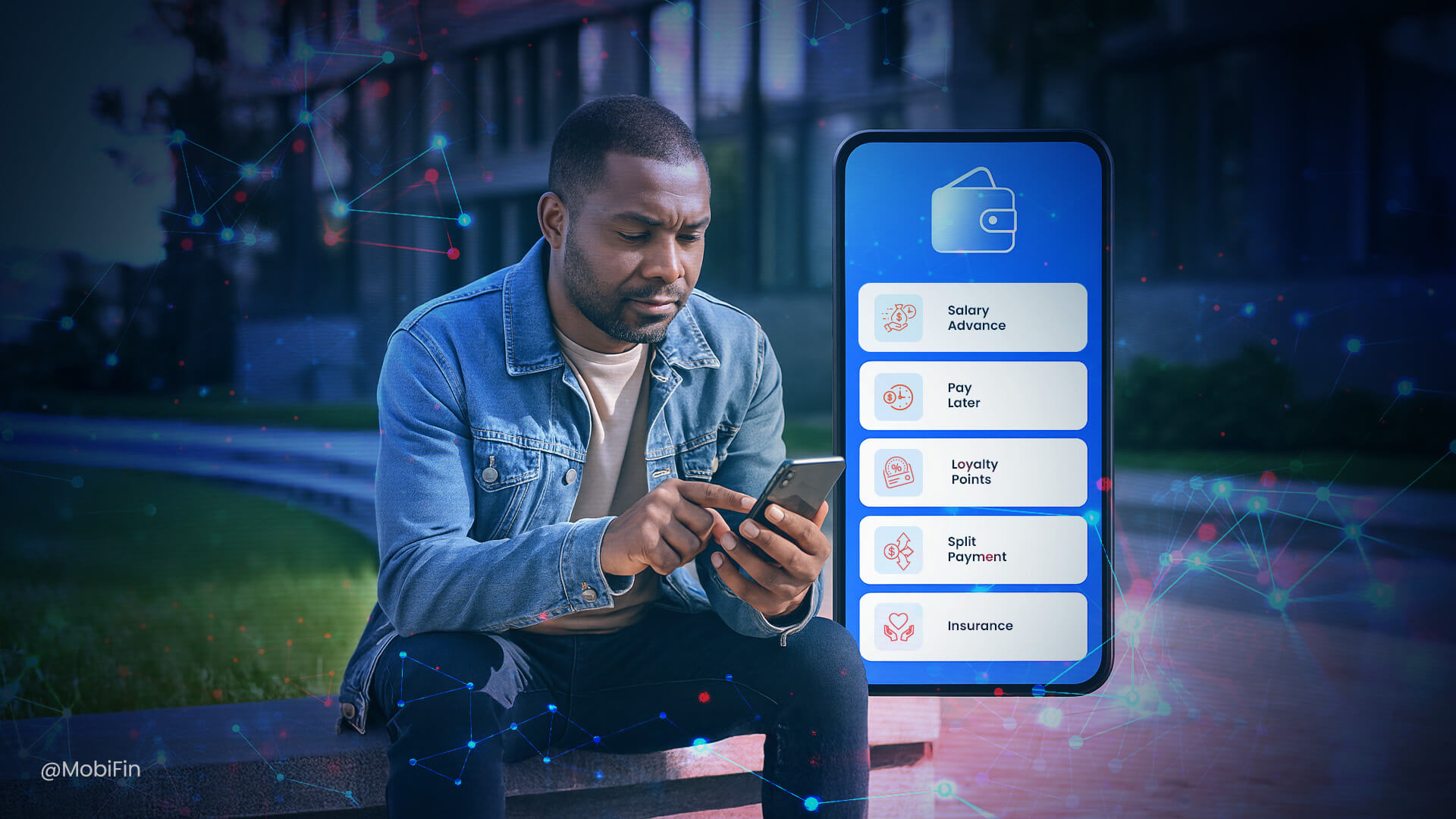

From wallet activity to real credit access

Translating behavioral data into actual credit offerings helps create a tangible impact. Lenders and wallet providers are increasingly using these signals to extend nano loans for emergency needs, salary advances on gig platforms, pay-later options, and pre-approved overdrafts to offer instant liquidity.

This shift isn’t just theoretical: it’s already shaping real-world use cases. For instance, a delivery rider on a platform like DoorDash or Gojek completes 50 orders in a week. The wallet linked to their earnings tracks steady income and on-time bill payments. The system automatically offers a $30 fuel advance inside the same app — no application, no bureau check. The loan is repaid automatically as earnings flow in. This is wallet-driven, embedded credit scoring in action.

Invisible credit history built from daily digital behavior: How wallets are turning into new credit bureaus

As digital wallets evolve beyond simple payment tools, they are quietly laying the foundation for an alternative credit infrastructure. Every top-up, bill payment, and peer transfer generate behavioral data that traditional bureaus have never captured. When aggregated, these patterns create a living, dynamic profile of financial trust. This shift is laying the groundwork for a future where creditworthiness is no longer tied to legacy institutions but to the everyday digital behaviors of millions of users.

Let’s understand how.

1. Wallets as credit data hubs

Digital wallets aggregate diverse transactions — payments, bills, savings, transfers — creating a pseudo-credit history for populations traditional bureaus can’t see. This history is built passively, simply by using the wallet for everyday needs.

2. Creation of a portable digital credit identity

The next step is making this behavioral data portable. A user’s wallet-based credit score could become a digital trust passport, shared across multiple lenders, microfinance providers, and even cross-border services. For example, a farmer in Kenya using M-Pesa to pay for seeds and utilities could present their wallet history to access a micro-loan from a different cooperative bank.

3. Interoperability, standards, and collaboration

For wallet-based credit scoring to scale beyond isolated use cases, ecosystem-level cooperation becomes essential. Regulators, central banks, and fintech consortia need to define open data protocols and API frameworks. Global development agencies are already exploring wallet-based scoring as a tool for financial inclusion, but interoperability is key to scaling it across institutions and borders.

4. Guardrails for ethical and inclusive use

With new data comes new responsibility. Behavioral credit scoring must be transparent, fair, and user-centric. It is important to create shared standards to prevent data monopolies. Let users control how their credit profiles are used. Also, make sure that users understand their score. Enforce non-discriminatory lending practices to avoid replicating bias.

5. Wallets as the new credit infrastructure

In the near future, the most powerful “credit bureaus” may not be institutions at all, but wallet ecosystems. Instead of brick-and-mortar offices holding static reports, real-time digital layers within wallets could offer billions of people their first fair, portable path to credit.

Real-world examples

- M-Pesa (Kenya): Wallet transaction data is used by lenders to offer working capital to small merchants and farmers.

- GCash (Philippines): Behavioral patterns within the wallet power GCredit, a micro-lending product for users with no bureau history.

- Alipay (China): The Sesame Credit model leverages wallet and e-commerce activity to extend instant credit lines without traditional scores.

These examples illustrate how wallet-based behavioral data bridges the gap between financial activity and credit access.

Conclusion

The future of credit scoring will not reside exclusively in bureaus: it will live in the wallets of the next billion digital users. For the unbanked, this evolution is transformative: opening access to working capital, enabling emergency resilience, and unlocking upward mobility.

Digital wallets are no longer just containers for value; they are containers for trust. By turning daily transaction data into behavioral credit signals, wallets are rewriting the rules of financial inclusion.

As interoperability standards emerge and regulators engage, wallets could become the default credit infrastructure for emerging markets. For billions of people who’ve never had a credit history, the path to opportunity may now fit in the palm of their hand.

If you’re building the next generation of inclusive financial services, get in touch with MobiFin experts. We would be glad to assist you.