Introduction: The uncomfortable reality of FinTech product development

Banks and FinTechs don’t move slowly because they lack ideas. They move slowly because they can’t fully trust what they build. In most FinTech organizations, testing environments are like illusions and a necessary compromise. APIs are partially available. Data is inadequate or synthetic. Behaviors differ from production. Orchestration logic is simplified or missing altogether. Launching without real validation leads to regulatory risk, operational outages, and broken customer journeys. A production-grade sandbox is the foundation for responsible innovation.

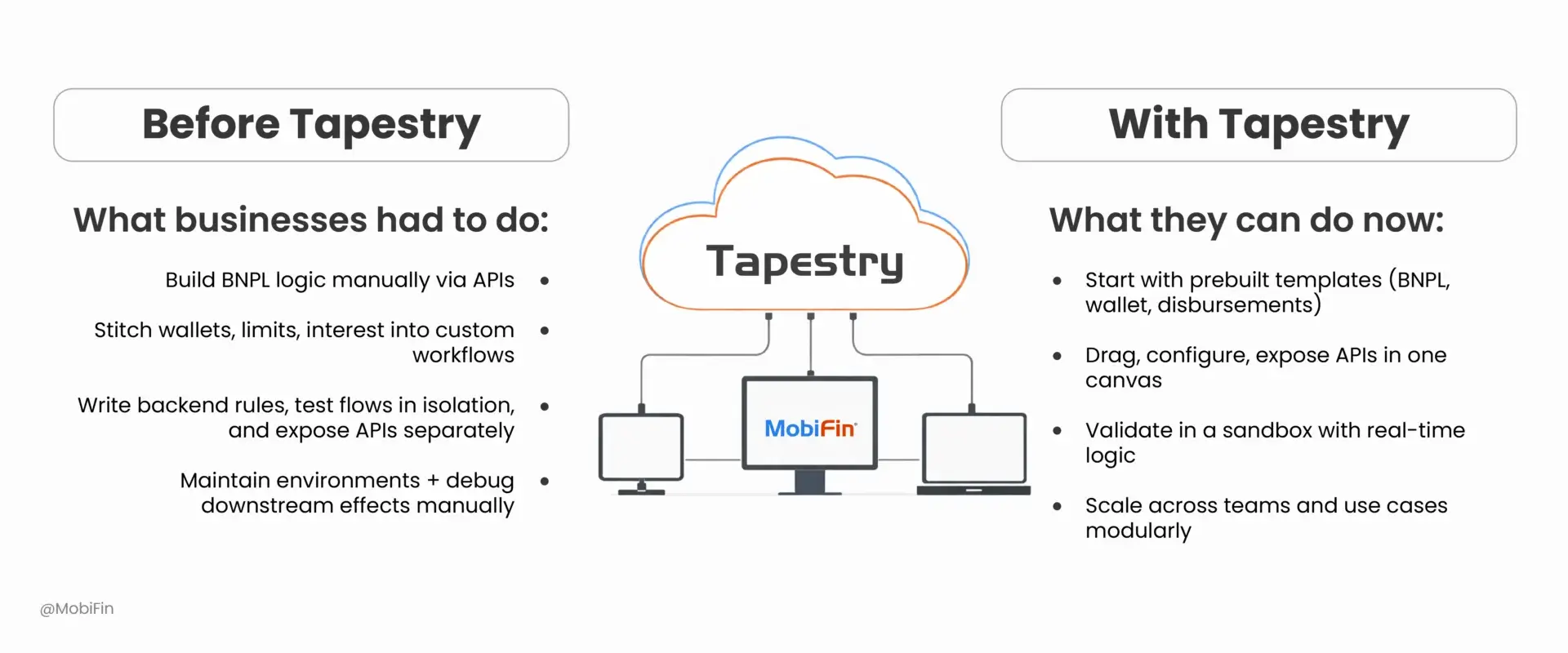

This is the problem Tapestry was built to solve. MobiFin Tapestry is an AI-led, orchestration-first platform where every product begins life in a sandbox that behaves like production.

Why FinTech product launches are inherently high-risk

Financial products are not single systems. They are coordinated behaviors across several systems. A typical launch involves core banking platforms, payment processors, KYC and identity providers, fraud engines, credit bureaus, wallets, notification services, telecom integrations, and multiple payment rails. Each dependency behaves differently across regions, partners, and environments.

Traditional testing environments fail to capture this reality. They can’t simulate latency, routing, and fallback behaviour. They rarely enforce rule engines, exposure limits, or regulatory checkpoints. They almost never test concurrency, retries, or partial failure states at scale.

Consequently, teams ship workflows they have never actually seen run end-to-end. The first real execution happens in production. The cost of these blind spots is production failures, compliance incidents, emergency rollbacks, delayed launches, and lost trust.

What a real FinTech sandbox must provide (and why most don’t)

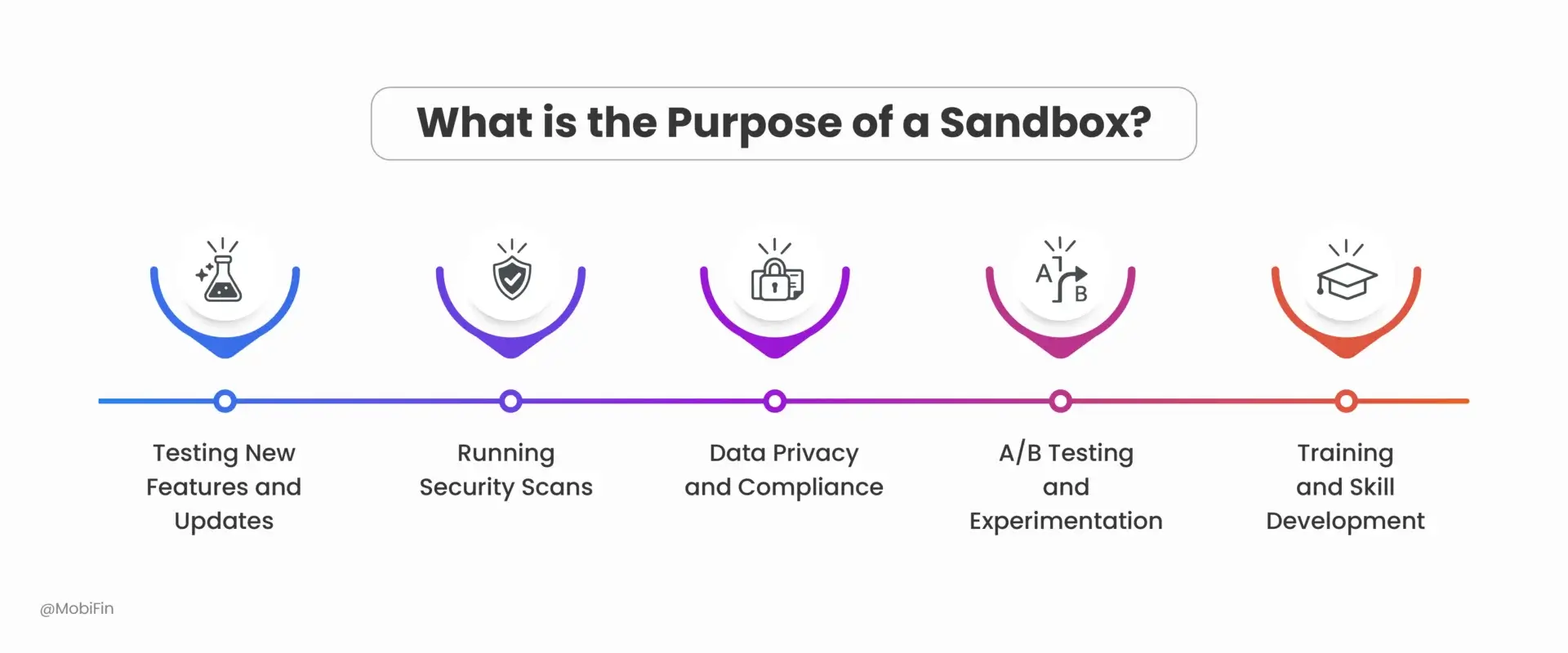

A powerful sandbox must go far beyond API mocking. It must support end-to-end journey simulation, not isolated endpoint testing. It must use realistic domain data, including balances, limits, KYC states, risk scores, and ledger impacts. It must execute real orchestration logic, including routing, retries, approvals, and decisioning. It must allow structured failure injection that covers timeouts, service degradation, and partner downtimes. It must support versioning, allowing multiple workflow variants to run in parallel. This facilitates clear comparison between outcomes. Most importantly, it must provide a clean and deterministic path to production. What works in the sandbox must work live. Anything less is theatre.

Most FinTech sandboxes are designed to test APIs in isolation, not products as systems. They validate request–response contracts, not behavioral flows. Orchestration, state management, and decision logic typically live outside the sandbox in application code or external services. As a result, these sandboxes can never fully reflect how financial products actually behave once multiple systems interact under real-world conditions.

Tapestry’s sandbox-first orchestration model

Tapestry is not an API proxy or testing tool layered on top of existing systems. It is a product composition engine with a built-in, production-grade sandbox. This shifts orchestration, state management, and execution logic out of fragmented application code and into a shared runtime that behaves consistently across environments.

Every new product created in Tapestry automatically generates a sandboxed environment that mirrors all orchestration logic. It will later run in staging and production. Financial primitives like payments, lending, KYC, risk, identity, and ledger touchpoints are native to the platform. Testing is meaningful because the platform understands financial behavior. AI assembles flows that run identically across sandbox, staging, and production because they are executed by the same orchestration engine, without any rewrites or surprises. Business, product, engineering, and compliance teams all work on the same execution model. The sandbox is not a separate environment. It is the starting point of product creation.

How Tapestry speeds up experimentation

Experimentation in FinTech is often limited by risk, dependencies, and long feedback loops. Here’s how Tapestry eliminates these barriers and speeds up experimentation so that teams can explore ideas safely and quickly. Here’s how:

Quick prototyping

Teams assemble full financial products using pre-built domain blocks. New ideas move from concept to working models in days, not quarters. Variations can be explored without rebuilding integrations.

Parallel experimentation

Journeys can be cloned, adjusted, and compared side by side. Routing logic, limits, fallback paths, and decisioning strategies can be validated in parallel without touching production systems.

Partner and ecosystem onboarding

New rails, bureaus, processors, and identity vendors can be introduced inside controlled sandbox. Their real behavior, including latency, failure patterns, retry sensitivity and data quality, is observed before engineering resources are committed. Dependency-driven delays are dramatically reduced.

How Tapestry de-risks financial product launches

Launching financial products involves lot more than feature readiness. Tapestry prevents failures during the launch in the following ways:

End-to-end validation

Tapestry helps validate orchestration across cores, processors, KYC, fraud, notifications, and ledgers, long before the launch. It also identifies the bottlenecks and dead ends early.

Compliance and governance testing

Rule engines, approval paths, consent checks, and exposure limits are executed directly in sandbox. With the help of Tapestry, you can verify governance before customers ever interact with the product.

Fail-safe and chaos scenarios

Outages, throttling, inconsistent partner behavior, and slow rails are simulated intentionally. Teams design resilient logic that holds under real-world pressure.

Environment drift elimination

The same orchestration logic, configuration, and execution paths move across sandbox, staging, and production, eliminating class-of-environment failures.

Closing the gap between testing and reality

In most FinTech teams, the journey from testing to production involves rewriting, reconfiguration, and last-minute fixes because the sandbox never truly reflects live behavior. Tapestry bridges this gap by using the same orchestration logic across sandbox, staging, and production.

Validated workflows move between environments through a single promotion, without recoding, reconfiguration, or hidden dependency changes. The rules, routing logic, limits, and failure handling that were tested remain the same when the product goes live.

For example, a digital lending journey tested in Tapestry’s sandbox can include credit bureau checks, risk scoring, loan limits, repayment schedules, and ledger postings. If a bureau times out or a payment rail slows down in sandbox, those behaviors are already accounted for in the workflow. When that same journey is promoted to production, it behaves identically under real conditions.

This deterministic execution removes environment drift, shortens go-live cycles, and significantly reduces post-launch incidents. Teams launch with confidence because they are deploying workflows they have already seen operate end-to-end, not assumptions that only exist on paper.

Who benefits most from Tapestry’s sandbox-led model

Not every organization faces the same level of complexity when building financial products, but those operating in regulated, multi-system environments feel it the most. Tapestry’s sandbox-led model is designed for teams that need to innovate quickly without compromising stability, compliance, or control. Here are some practical examples where Tapestry delivers the maximum value:

- Banks modernizing digital stacks without betting the bank.

- FinTechs running rapid experiments across new product categories.

- SuperApp ecosystems coordinating multi-domain journeys.

- Aggregators onboarding partners with predictable quality.

- Product, engineering, risk, and compliance teams seeking shared truth.

Advantages and end-result of sandbox-first orchestration

Through sandbox-first orchestration in Tapestry, you can eliminate guesswork and ensure products are fully validated before reaching production. As a result, you can launch them confidently. Teams can iterate faster without increasing risk. It reduces integration costs and operational overhead. Production failures and emergency escalations become far less frequent, as workflows are designed to handle real-world conditions from the start. Simultaneously, collaboration across business, risk, and engineering teams improves because everyone works from a shared execution model. The outcome is continuous, controlled innovation rather than isolated, one-time builds.

Conclusion

Financial innovation should not require gambling with production systems. A real sandbox, backed by a real orchestration engine is the only way to build safety at speed. That’s Tapestry for you. It turns sandbox-led product composition into a core capability. Ultimately, FinTech teams can launch faster, operate safer, and innovate with full conviction.

If you are curious how sandbox-led orchestration fits your roadmap, talk to our Tapestry experts right away.