Localization is the new currency of user engagement in SuperApps. SuperApps are redefining convenience and connectivity across emerging markets. However, while their promise of “everything in one app” is universal, success is not. That’s because ‘one-size-fits-all’ doesn’t work across markets.

A truly hyperlocal UX must reflect not just language and culture but also everyday habits, regulatory nuances, and payment behaviors. For example, features and contextual differences that drive success in Indonesia may fail in Kenya, or vice versa, because local needs differ. Every region differs in user expectations, trust dynamics, and financial context.

The strategic edge of hyperlocal UX

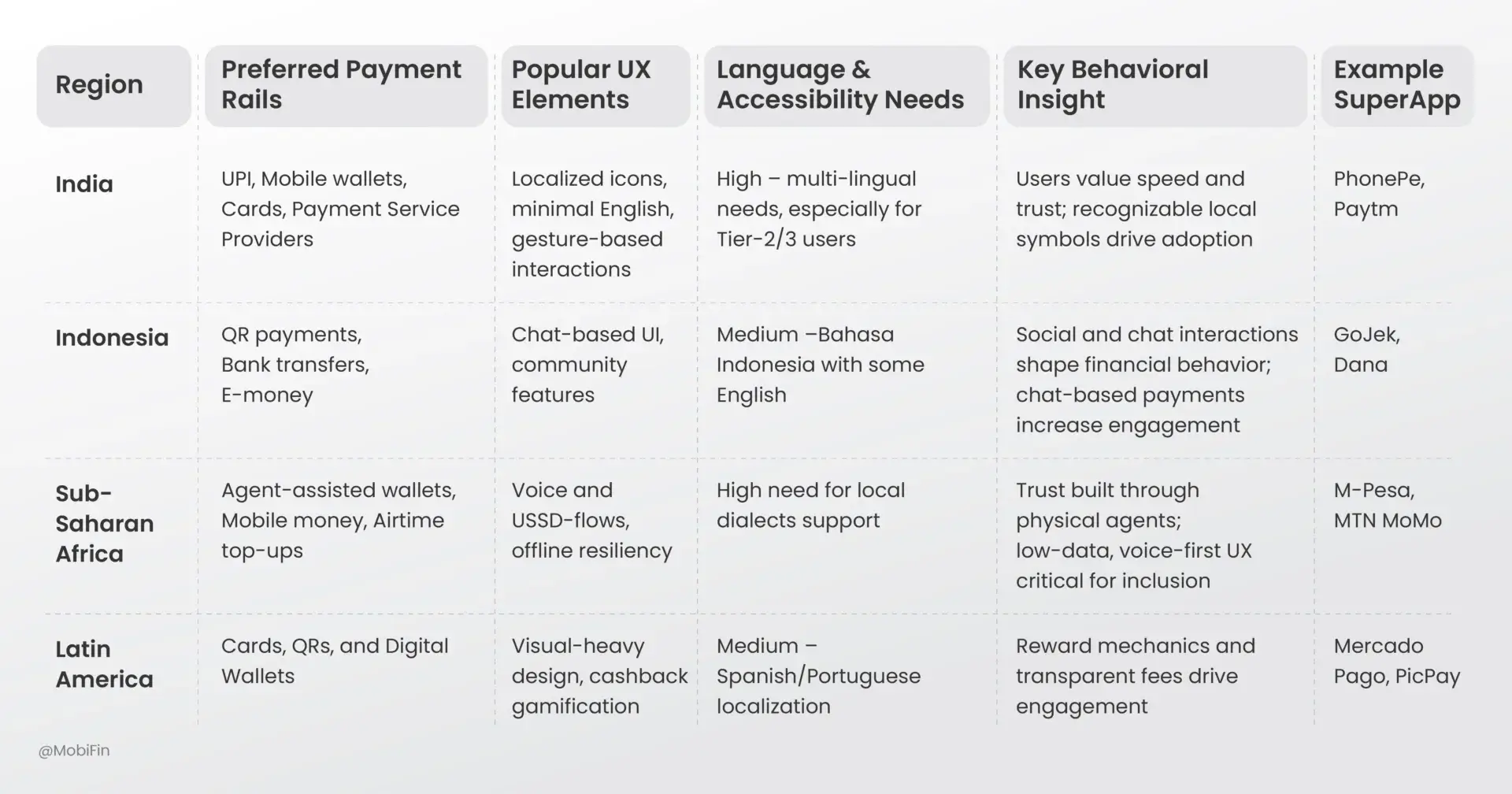

One often-quoted industry statistic conveys that every USD 1 invested in UX design results in a USD 100 return. It translates to 9900% ROI. That multiplier applies particularly to SuperApps, where a single interface must serve multiple services, behaviors, and trust models. SuperApps that adapt to local needs win user trust and loyalty and reduce churn. Payment preferences vary: some users prefer cash or agent-assisted flows, others rely on mobile wallets, bank transfers, or UPI-style rails. SuperApps must accommodate these differences natively. Chat-based support and agent touchpoints matter in many markets: some users rely on chatbots or on-the-ground agents for reassurance before transacting. Colors, layouts, icons, and tone of voice that resonate locally strengthen emotional connection and perceived legitimacy. Local compliance, data residency requirements, transaction caps, and KYC norms vary by region, UX must adapt to these constraints transparently.

UX design and payment behavior across markets

How to design hyperlocal experiences

Building a SuperApp that feels truly local in each market requires thoughtful localization embedded into every UX touchpoint. A hyperlocal experience ensures that users from different geographies feel seen, understood, and connected to the platform within their cultural and behavioral context.

Language and accessibility form the foundation of this approach. SuperApps must go beyond literal translation to deliver multilingual interfaces that use localized terminology, idioms, and conversational tone. Supporting regional scripts, voice navigation, and chat interfaces makes the app accessible to both tech-savvy youngsters and first-time digital adopters.

Payments integration plays a critical role in user trust and convenience. Through plug-and-play APIs and modular adaptors, SuperApps can connect natively to local banks, wallets, payment service providers, and national rails. Supporting region-specific authentication, settlement windows, currency flows, and reconciliation rules ensures transactions feel familiar and frictionless for users.

Cultural aesthetics influence emotional connection and usability. Incorporating regional color psychology, local imagery, and culturally resonant symbols can make interfaces feel more authentic and reduce friction. Even small touches like temporary festival themes, localized microcopy, and regional onboarding flows can create a deeper sense of belonging.

AI-driven behavioral insights help product teams understand regional usage trends and payment behaviors in near-real time. Geo-segmented analysis enables the app to personalize offers, recommendations, and UI patterns to match local preferences and habits. For instance, Region A may favor cashback, Region B may prefer percentage discounts, and Region C may engage more with gamified incentives tied to social sharing.

Finally, robust accessibility ensures no user is left behind. SuperApps must perform reliably even in low-bandwidth environments by offering lightweight modes, progressive web apps, offline caching, and optimized assets. These measures extend access to rural and infrastructure-limited users, expanding reach and building trust.

When combined, these principles create a truly hyperlocal SuperApp experience: adaptive, culturally respectful, and empowering users through familiarity and accessibility.

Case studies: SuperApps that got it right

The most impactful SuperApps are those that align product design to local market nuances.

Here are three standout examples, GoJek, WeChat, and Grab, that demonstrate how hyperlocal UX, cultural awareness, and regional innovation turn everyday convenience into enduring user loyalty.

1. GoJek (Indonesia)

From ride hailing to payments, GoJek succeeded by understanding “ojek” culture — informal motorcycle taxis deeply rooted in local life. It integrated pulsa (mobile credit) and local services. The app not only simplified access for underbanked users but also built loyalty through trust and on-the-ground operations.

2. WeChat (China)

The pioneer of SuperApps became indispensable by merging social networking with financial services. WeChat introduced “Red Packet” gifting based on cultural traditions. It was an open mini-program ecosystem for merchants and developers, and seamless chat-to-commerce payments made it the hub of daily digital life.

3. Grab (Southeast Asia)

Grab’s success lies in its multi-country localization approach. It offers customized service hierarchies per market. It expands inclusion by forming regional payment partnerships. By integrating hawker center payments in Singapore, a hyperlocal touchpoint, they built community trust and everyday utility.

Conclusion

In the race to build all-in-one digital ecosystems, the most successful SuperApps are those that feel like they were built by locals, for locals. Hyperlocal UX is the foundation for user trust, regulatory compliance, and sustained engagement.

At MobiFin, we help design and deploy SuperApp-powered ecosystems that are globally scalable yet locally relevant. Using our proven fintech frameworks, AI-driven personalization tools, and composable architecture, businesses can deliver tailored digital experiences that resonate across regions.

If you’d like to learn more, contact our SuperApp experts to discuss localization, payments integration, and deployment strategies.