Central Bank Digital Currencies (CBDCs) offer a secure, low-cost, and accessible alternative to cash. They enable individuals to store, transfer, and receive money digitally without needing a traditional bank account. Through integration with existing financial technologies, CBDCs can empower unbanked populations by creating an inclusive and equitable financial system.

CBDCs for the Unbanked: A Game-Changer in Financial Inclusion

For decades, financial exclusion has prevented millions from accessing essential banking services —forcing them to rely on cash or costly informal alternatives. Unlike private digital payment platforms that often require bank accounts or charge high fees, CBDCs provide a state-backed, cost-effective, and universally accessible alternative to cash.

With mobile phones now more common than bank accounts, CBDCs can deliver secure, cashless transactions to even the most underserved populations. But how can governments ensure widespread adoption, and what challenges lie ahead? Below, we examine whether CBDCs truly live up to their promise as a financial inclusion tool.

We also explore the key ways they’re bridging the gap for the unbanked.

- Bank-free transactions: CBDCs can be structured to enable individuals to carry out financial transactions without requiring a conventional bank account. This is especially advantageous in regions where a large segment of the population remains unbanked. People can make easy, secure payments using government-approved digital wallets.

- Lower financial barriers: Many traditional banking services impose fees that may be burdensome for low-income individuals. CBDCs have the potential to minimize these expenses, making transactions more cost-effective and expanding financial inclusion.

- Improved security and transparency: Digital currencies issued by central banks offer a more secure and transparent financial ecosystem, reducing the vulnerabilities associated with cash-based transactions, such as fraud and theft. Enhanced security can boost user confidence, fostering a gradual shift toward digital financial solutions.

- Better accessibility via mobile/offline payments: CBDCs can operate through mobile devices and even offline networks. Many developing economies have high mobile penetration but low banking penetration. Also, offline CBDC functionality (via smart cards or NFC-based transactions) ensures accessibility in remote areas with limited connectivity, accelerating financial inclusion.

- Enhanced microfinance and small business growth: CBDCs can drive financial inclusion for small businesses, street vendors, and gig workers. CBDCs can facilitate microloans and instant payments to support small business liquidity and enable faster cross-border remittances for migrant workers sending money home. It leads to lower dependency on cash, reduced risks, and improved financial planning.

- Higher financial literacy and digital adoption: With many unbanked individuals hesitating to use digital banking due to lack of trust or awareness, CBDCs can encourage financial education. Government-backed CBDC education programs can help individuals understand digital transactions, budgeting, and financial planning. CBDCs can serve as a gateway to broader financial services, such as savings accounts, investments, and insurance.

- Raised government aid and social welfare: CBDCs enable efficient and transparent government payments. Many low-income beneficiaries face delays, uncertainties, or financial leakages in welfare and subsidy payments. CBDCs allow direct digital transfers from central banks or governments to individuals, ensuring timely and accurate delivery. Programmable CBDCs can ensure funds are used for intended purposes (e.g., food, education, healthcare).

What is Central Bank Digital Currency (CBDC)?

A central bank digital currency (CBDC) is a digital version of a nation’s official currency, issued and managed by the country’s central bank. There are two types of CBDC – retail (used by consumers in everyday transactions) and wholesale (used by financial institutions). Unlike decentralized cryptocurrencies such as Bitcoin, CBDCs are fully backed by the government and are designed to serve as a secure and stable medium of exchange, unit of account, and store of value. Their core purpose is to function similarly to physical cash but in an advanced digital format.

Why Are Central Banks Launching Digital Currencies?

In advanced economies, central banks are primarily focused on maintaining monetary sovereignty and enhancing payment efficiency. Meanwhile, in emerging markets, the primary goal is to expand financial inclusion and provide banking access to underserved populations. As a result, central banks outside Europe have identified more potential use cases for CBDCs than their Western counterparts. By 2024, the most actively used CBDCs were found in China, Nigeria, the Bahamas, and Jamaica.

Major Developments and Growing Trends in CBDCs

Global interest among central banks in developing CBDCs remains buoyant in early 2025. Several nations have recently launched pilot programs, while others continue advancing their existing trials, demonstrating steady progress in digital currency adoption. Projections indicate that the value of payments via CBDCs will reach $213 billion annually by 2030, up from just $100 million in 2023, reflecting the early stages of the sector and the anticipated rapid growth.

A Deutsche Bank Research dbDIG proprietary survey, conducted in March 2024, revealed that 16% of consumers across the euro area, the UK, and the US expect CBDCs to become widely adopted. The findings also indicate that consumers favor CBDCs over private cryptocurrencies like Bitcoin and Ethereum. However, uncertainty continues—57% of respondents expressed a preference for using debit or credit cards, while 44% stated they would rather use cash than a government-issued digital currency.

As of early 2025, CBDCs have gained widespread attention across the globe:

- China: As a frontrunner in CBDC innovation, China officially expanded the use of its Digital Yuan (e-CNY) in 2024. After several years of testing, the e-CNY became a key component of both domestic transactions and international trade.

- India: The Digital Rupee saw widespread adoption in 2024, largely due to its integration with India’s Unified Payments Interface (UPI). To promote its use, the Reserve Bank of India (RBI) introduced incentives for both merchants and consumers, ensuring smoother transactions in both rural and urban regions. Also, in January 2025, one of India’s largest digital wallets announced that it has launched a full version of India’s CBDC – e-rupee (e₹) –for all its Android users, in partnership with Reserve Bank of India (RBI) and Yes Bank. This allows users to make peer-to-peer and peer-to-merchant transactions using e-rupees, which are fully interoperable with UPI.

- European Union: Following extensive consultations and pilot programs, the European Central Bank (ECB) introduced the Digital Euro to create a more unified financial framework across EU member states. Designed to enhance cross-border trade, the Digital Euro aimed to decrease dependence on private payment systems like Visa and Mastercard. It also introduced offline transaction capabilities, making it accessible in remote areas with limited internet connectivity.

- Nigeria: After a successful eNaira pilot in 2021, Nigeria expanded its CBDC’s application to include everyday transactions and international remittances. The Central Bank of Nigeria partnered with neighboring countries to ensure regional interoperability, reinforcing the eNaira’s role as a vital component of West Africa’s digital financial ecosystem.

- Ghana: The Bank of Ghana (BoG) is set to roll out the retail version of its central bank digital currency (CBDC), the eCedi, by the end of 2025. For the eCedi, a key priority in its launch strategy was ensuring it could be used for offline payments. With 47% of Ghanaians lacking internet access, a CBDC without offline functionality would exclude nearly half the population and undermine financial inclusion efforts.

Bottlenecks in Market Scalability

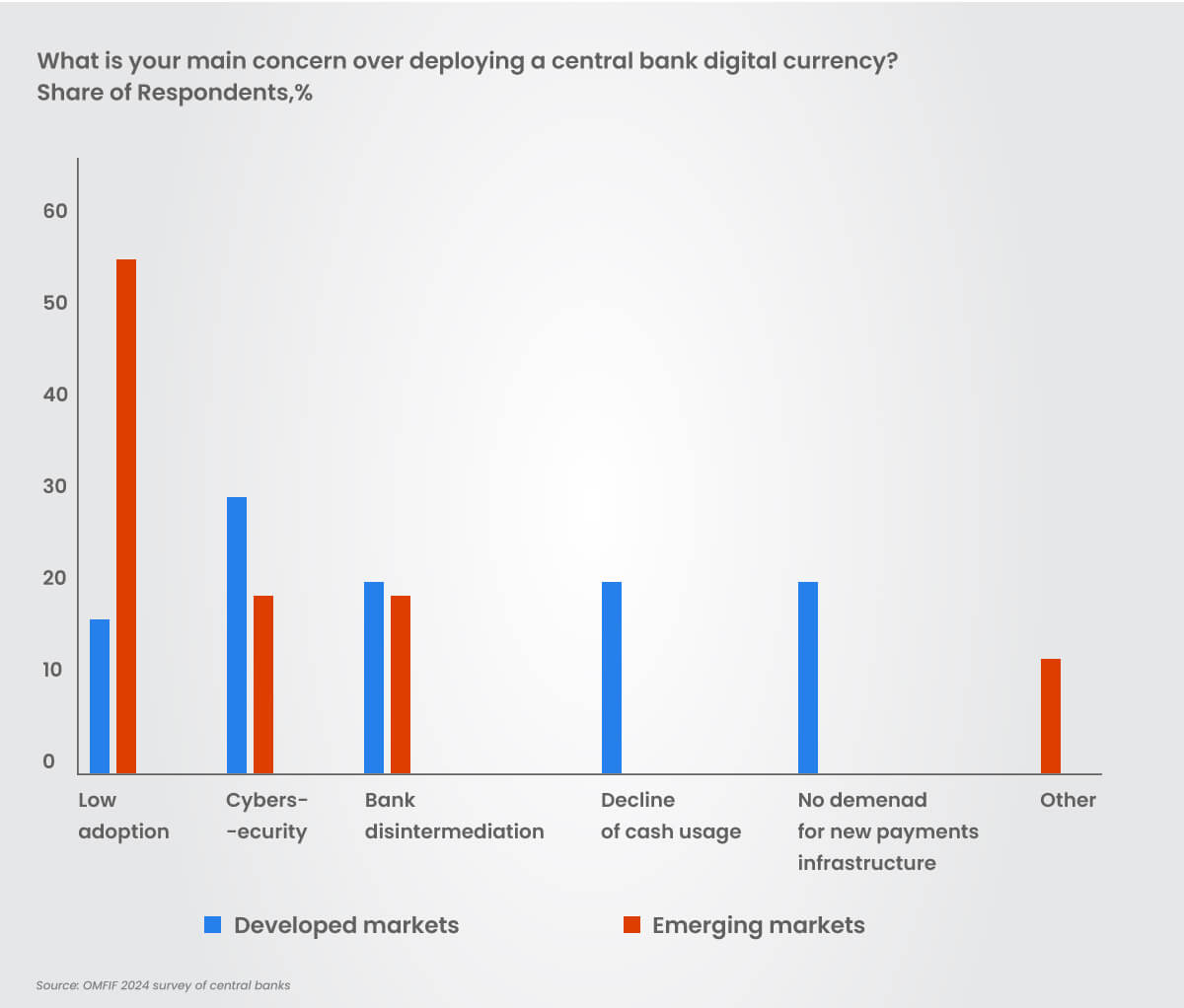

Furthermore, a recent survey conducted by the Official Monetary and Financial Institutions Forum (OMFIF) and security technology firm, Giesecke+Devrient Currency Technology, published on February 11, 2025, analyzed the stance of 34 central banks. 56% of emerging market survey participants are concerned about low adoption of CBDCs by users. Even though central banks worry about low adoption rates, many still expect CBDCs to be introduced soon. They appear determined to move forward with their plans while carefully tackling any challenges and concerns along the way.

Low adoption still leading concern

Source: OMFIF 2024 survey of central banks

Despite the hesitations and shifting policies, the overall outlook for CBDCs remains optimistic, with many central banks actively assessing their potential. However, regulatory clarity and economic stability will play a crucial role in determining how and when these digital currencies become a reality.

CBDC’s success will depend on strong regulatory frameworks, financial literacy programs, and partnerships between governments, fintechs, and financial institutions.

A Long-term Perspective

Most CBDC initiatives are unlikely to be completed by 2024 or even 2025. In Europe, the launch of the digital euro is anticipated sometime between 2026 and 2029. Meanwhile, the United States Federal Reserve published its initial CBDC assessment in 2022, suggesting that it lags behind nations already working on retail-oriented digital currencies. Additionally, countries such as Canada and the United Kingdom are primarily exploring blockchain technology to enhance banking operations rather than focusing on direct consumer use. One possible reason for this approach is that privacy concerns among EU citizens have made the introduction of a digital euro a sensitive issue.

CBDCs have attracted significant attention, both for their potential in everyday transactions and for how they contrast with the decentralized principles that define cryptocurrencies. As one of the first big use cases of blockchain technology for a wide audience, this attention is unlikely to go away any day soon.