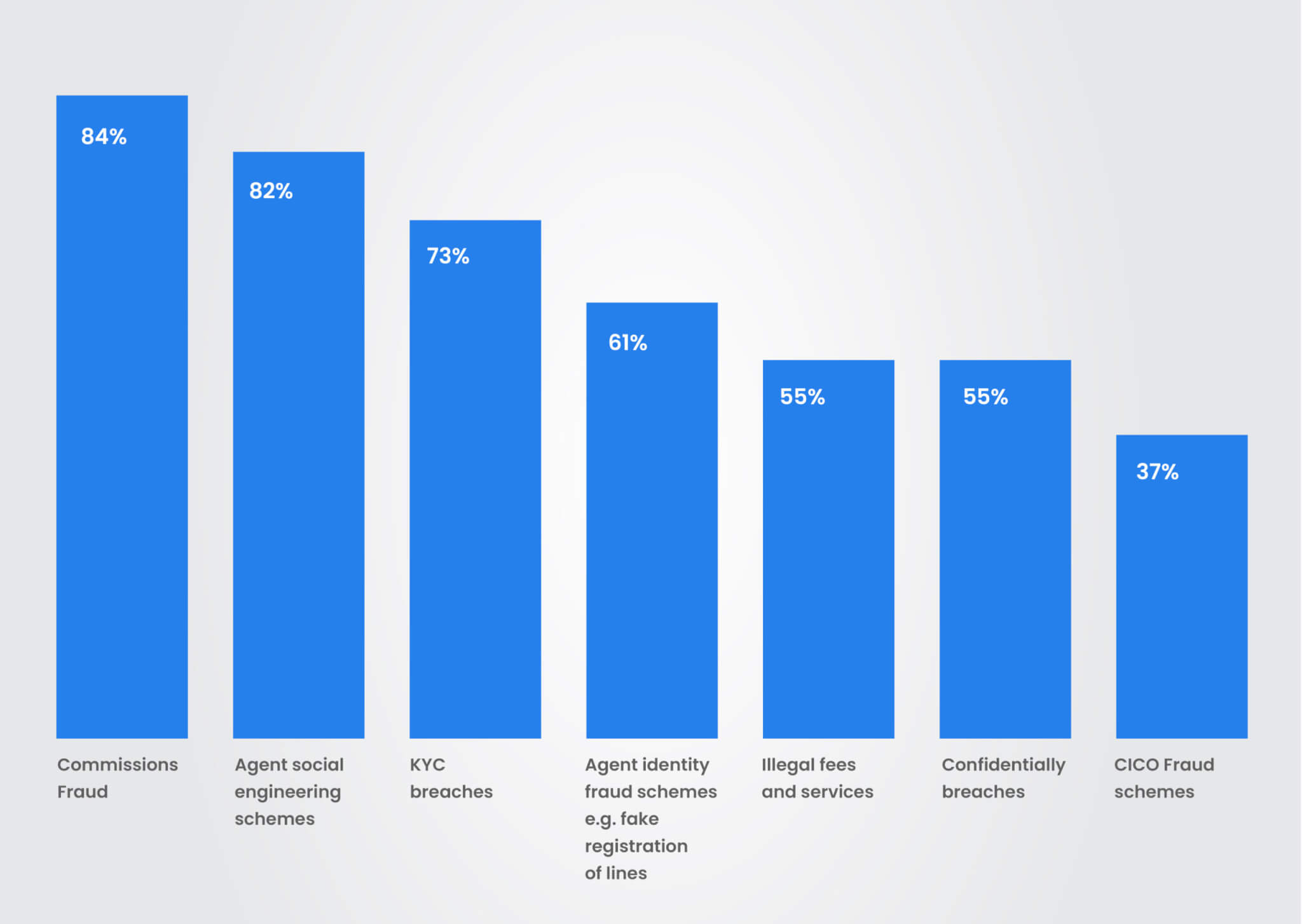

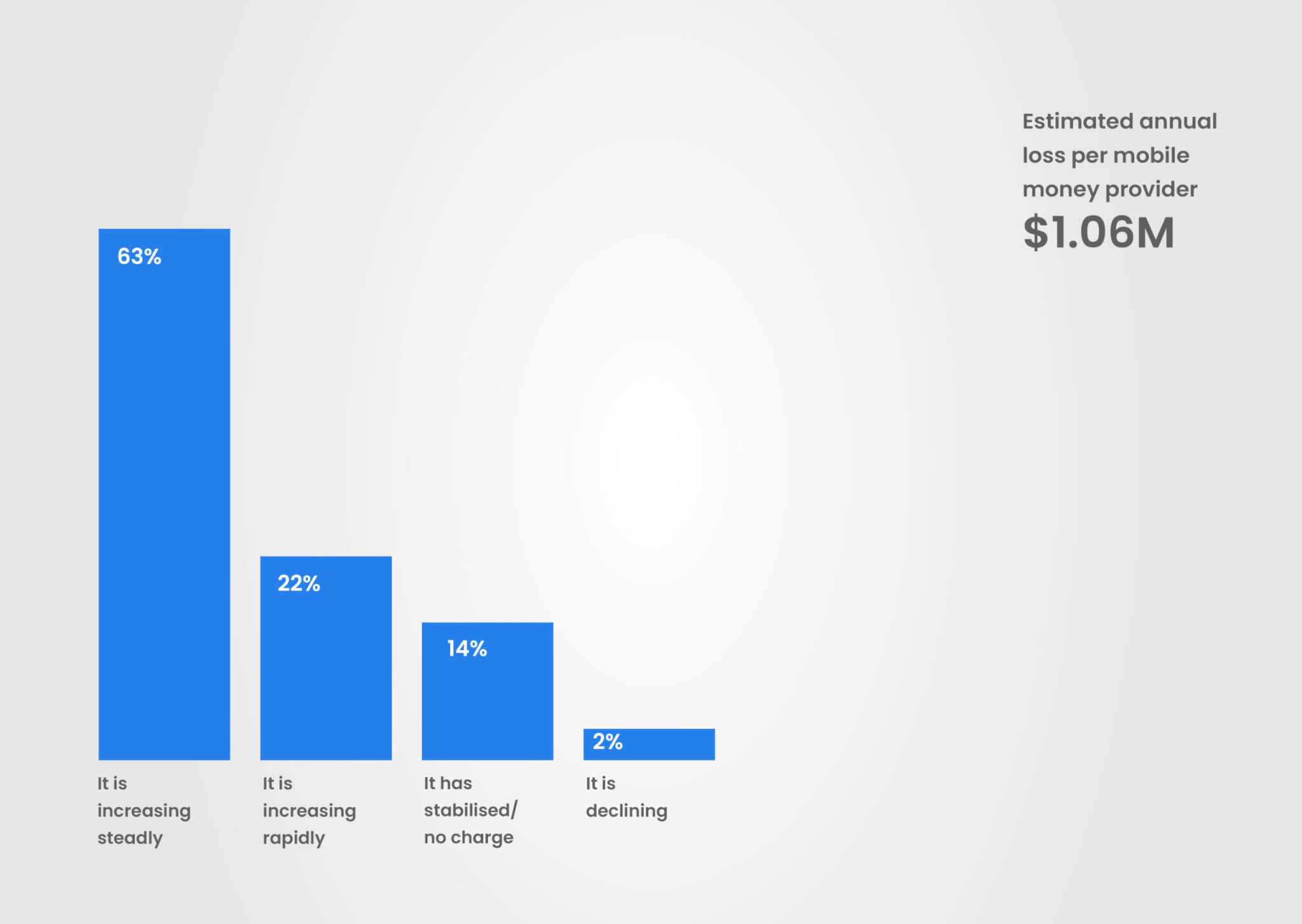

Perpetrated by agents with access to sensitive systems, these frauds can undermine customer trust, compromise business integrity, and result in financial losses. A GSMA report indicates that mobile money providers have experienced approximately $1.06 million in losses due to insider fraud. Yet this figure likely underrepresents the full scope, given the sector’s under-reporting, fragmented oversight, and operational complexity.

Understanding these frauds is vital for financial institutions, regulators, and stakeholders to build robust preventive strategies for their businesses. This blog offers telecom and digital finance leaders a deep dive into the anatomy of insider fraud, its systemic enablers, and enterprise-level strategies to mitigate its risk.

Source: GSMA

Understanding Agent Insider Fraud in Mobile Money and Agency Banking

Insider fraud within the mobile money and agency banking sectors arises when agents, entrusted with access to customer accounts and systems, exploit this privilege for personal gain. This often stems from a desire to maximize commissions. Unlike external threats, insider fraud is particularly gradual and cumulative because it exploits legitimate access, making it harder to detect, quantify, and investigate. Here are some common types of agent insider fraud:

- Commission Pushing: In this fraud type, agents may manipulate transactions to earn higher commissions, such as encouraging customers to break large transactions into smaller ones to increase commission payouts or strategically guiding customers towards higher-commission services, irrespective of need.

- Split Transactions: In this fraud type, agents may encourage customers to split transactions into smaller amounts to earn multiple commissions instead of a single commission on the total amount. For example, when a customer deposits $210, it may earn an agent $2 in commission. If the agent splits the transaction into two at $105 each, they can earn $1.50 each, bringing the total to $3. In such scenarios, the agent may tell the customer that the agent account cannot accept the $250 as a single transaction due to a ‘technical limit’, and the customer agrees to split the transaction.

- Arbitrage through Fund Circulation: In this fraud type, agents may engage in circular transactions, such as depositing and withdrawing funds from fictitious accounts, to generate illegitimate commissions. For instance, using fake accounts agent deposits funds in fictitious accounts and proceeds to transfer money to other accounts before withdrawing the funds, thereby earning withdrawal commissions for illegitimate transactions. This tactic not only inflates transaction metrics but also distorts liquidity projections.

- Cash-In/Cash-Out (CICO) Fraud: CICO fraud involves agents short-changing customers during withdrawals, depositing less e-money, or engaging in fraudulent currency schemes, often exploiting customer trust. In areas with limited digital literacy, such acts often go unnoticed and unreported.

- Hierarchy Fraud: In this fraud type, super-agents may withhold a portion of the commissions owed to sub-agents, exploiting their position within the agency network. An example is where the master agent withholds part of commission payable to sub-agents. This exploitative behavior is difficult to flag due to the layered structures of agent networks.

- Illegal Fees: In this fraud type, agents may charge unauthorized fees for services that should be free (such as balance inquiries or password resets) or for non-financial services, misusing the trust of the user and exploiting customer ignorance.

- KYC Breaches: Agents may neglect KYC protocols, onboarding customers without proper verification, and facilitating ‘direct’ transactions without required identification. This allows high-risk accounts into the system, often linked to money laundering or transaction anonymization.

Why Insider Fraud Thrives: Structural and Systemic Factors

- Access to Sensitive Data: Agents handle sensitive customer information, transaction systems, and cash, creating opportunities for exploitation. They interact directly with transaction interfaces and handle physical cash but operate outside of core banking environments. This mix of access and autonomy is fertile ground for misconduct.

- Decentralized Operations: The decentralized nature of agency banking and mobile money networks makes real-time monitoring of agent activities challenging. In many markets, agent networks scale rapidly without commensurate investments in governance, audits, or supervisory controls. This creates blind spots, especially in rural and Tier-3 locations.

- Limited Oversight and Training: Insufficient agent vetting and limited training on ethical conduct and fraud prevention create vulnerabilities. Agents are often recruited informally with little or no background checks. Many lack training in fraud awareness, data privacy, or ethical handling of customer transactions.

- Weak Security Protocols: A lack of robust fraud detection systems allows fraudulent transactions to go undetected. Many platforms rely on static rule-based alerts that fail to catch nuanced or low-value but high-frequency fraud patterns. Additionally, insufficient integration between transaction systems and audit trails limits the ability to trace and verify suspicious agent behavior in real-time.

- Inconsistent Regulatory Enforcement: While central banks and regulators have guidelines, actual enforcement across dispersed networks remains uneven, especially when telecom operators and financial institutions have joint ownership of agent models.

Strategies to Mitigate Insider Agent Fraud

Preventing insider fraud demands more than reactive policing. It requires a multi-tiered strategy spanning operational processes, technology, and cross-sector collaboration. The following suggestive strategies can prove beneficial in mitigating the insider agent frauds.

- Comprehensive Screening and Training: Implement enterprise-wide agent vetting and rigorous recruitment processes, including thorough background checks, and provide comprehensive training on ethical conduct, fraud prevention, and cybersecurity.

- Robust Security Measures: Implement multi-factor authentication, transaction monitoring, role-based access control, and regular software updates to address security vulnerabilities. Restrict access to customer KYC data and system functions based on the agent’s role and transaction volume.

- Independent Audits: Conduct regular independent audits to ensure transparency and detect irregularities. Set up third-party audits for both master and sub-agent operations and run mystery shopper programs and randomized field verifications.

- Whistleblower Policies: Establish secure and confidential channels for employees and customers to report suspicious activities. Provide free hotlines to report suspicious behavior with guaranteed follow-up.

- Customer Awareness: Educate customers about common fraud tactics and their rights to empower them to recognize and report suspicious activity. Launch SMS or USSD alerts for every agent-initiated transaction.

- Collaborative Efforts: Foster collaboration between financial institutions, regulators, and industry players to share intelligence and develop inter-operator fraud sharing networks. Work with national financial intelligence units (FIUs) to monitor high-risk agent behaviors.

- Leveraging Technology: Utilize data analytics and artificial intelligence to identify suspicious patterns and anomalies in transaction data.

Conclusion

Insider agent fraud poses a significant threat to the integrity and stability of the mobile money and agency banking sectors. By implementing robust security measures, enhancing agent training, and fostering a culture of transparency and accountability, the industry can effectively mitigate these risks and ensure the continued growth and sustainability of these vital financial services. Only then can mobile money and agency banking continue to thrive as pillars of modern financial ecosystems.

Embed trust into the architecture – with strategic investments in people, platforms, and policy alignment, telecom and fintech players can secure the future of digital financial ecosystems.

Contact us to know how MobiFin can help you prevent and eliminate frauds that persist in agency banking and mobile money.